GNC 2011 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2011 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

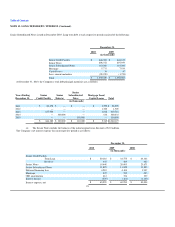

Table of Contents

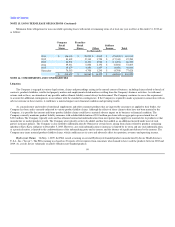

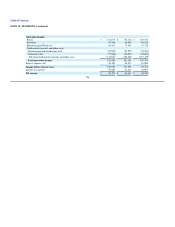

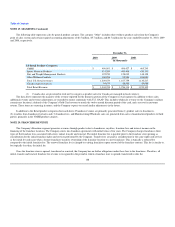

NOTE 15. LONG-TERM LEASE OBLIGATIONS (Continued)

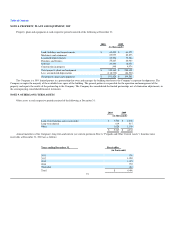

Minimum future obligations for non-cancelable operating leases with initial or remaining terms of at least one year in effect at December 31, 2010 are

as follows:

Company

Retail

Stores

Franchise

Retail

Stores Other Sublease

Income Total

(in thousands)

2011 $ 106,103 $ 23,095 $ 4,812 $ (23,095) $ 110,915

2012 83,492 17,310 3,758 $ (17,310) 87,250

2013 63,591 11,491 2,928 $ (11,491) 66,519

2014 49,411 6,806 2,192 $ (6,806) 51,603

2015 35,677 3,454 1,237 $ (3,454) 36,914

Thereafter 76,383 4,708 1,245 $ (4,708) 77,628

$ 414,657 $ 66,864 $ 16,172 $ (66,864) $ 430,829

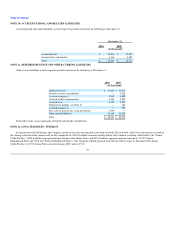

NOTE 16. COMMITMENTS AND CONTINGENCIES

Litigation

The Company is engaged in various legal actions, claims and proceedings arising in the normal course of business, including claims related to breach of

contracts, products liabilities, intellectual property matters and employment-related matters resulting from the Company's business activities. As with most

actions such as these, an estimation of any possible and/or ultimate liability cannot always be determined. The Company continues to assess the requirement

to account for additional contingencies in accordance with the standard on contingencies. If the Company is required to make a payment in connection with an

adverse outcome in these matters, it could have a material impact on its financial condition and operating results.

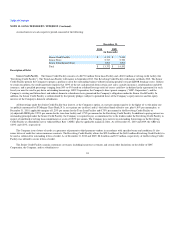

As a manufacturer and retailer of nutritional supplements and other consumer products that are ingested by consumers or applied to their bodies, the

Company has been and is currently subjected to various product liability claims. Although the effects of these claims to date have not been material to the

Company, it is possible that current and future product liability claims could have a material adverse impact on its business or financial condition. The

Company currently maintains product liability insurance with a deductible/retention of $3.0 million per claim with an aggregate cap on retained loss of

$10.0 million. The Company typically seeks and has obtained contractual indemnification from most parties that supply raw materials for its products or that

manufacture or market products it sells. The Company also typically seeks to be added, and has been added, as an additional insured under most of such

parties' insurance policies. The Company is also entitled to indemnification by Numico for certain losses arising from claims related to products containing

ephedra or Kava Kava sold prior to December 5, 2003. However, any such indemnification or insurance is limited by its terms and any such indemnification,

as a practical matter, is limited to the creditworthiness of the indemnifying party and its insurer, and the absence of significant defenses by the insurers. The

Company may incur material products liability claims, which could increase its costs and adversely affect its reputation, revenues and operating income.

Hydroxycut Claims. On May 1, 2009, the FDA issued a warning on several Hydroxycut-branded products manufactured by Iovate Health Sciences

U.S.A., Inc. ("Iovate"). The FDA warning was based on 23 reports of liver injuries from consumers who claimed to have used the products between 2002 and

2009. As a result, Iovate voluntarily recalled 14 Hydroxycut-branded products.

99