GNC 2011 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2011 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

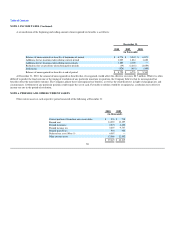

NOTE 12. LONG-TERM DEBT / INTEREST (Continued)

In accordance with the terms of the Senior Subordinated Notes purchase agreement and the offering memorandum, these notes were required to be

exchanged for publicly registered exchange notes within 210 days after the sale of these notes. As required, these notes were registered and the exchange offer

was completed on September 28, 2007.

The Company expects to fund its operations through internally generated cash and, if necessary, from borrowings under the amount remaining available

under the Revolving Credit Facility. The Company expects its primary uses of cash in the near future will be debt service requirements, capital expenditures

and working capital requirements. The Company anticipates that cash generated from operations, together with amounts available under the Revolving Credit

Facility, will be sufficient to meet its future operating expenses, capital expenditures and debt service obligations as they become due. However, the

Company's ability to make scheduled payments of principal on, to pay interest on, or to refinance the Company's indebtedness and to satisfy the Company's

other debt obligations will depend on the Company's future operating performance, which will be affected by general economic, financial and other factors

beyond the Company's control. The Company believes that it has complied with the Company's covenant reporting and compliance in all material respects for

the year ended December 31, 2010.

Proposed Refinancing. On February 7, 2011, the Company announced that it intends to enter into, subject to market and other conditions, a financing

transaction with certain lenders. The Company currently expects to use the proceeds from the transaction, if consummated, to, among other things, refinance

its existing indebtedness. There can be no assurance that the Company will complete any such refinancing either on terms acceptable to it, or at all.

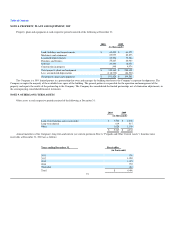

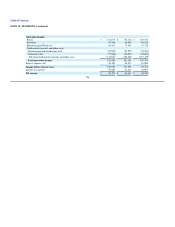

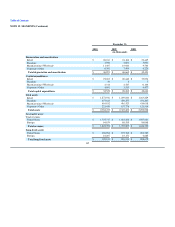

NOTE 13. OTHER LONG TERM LIABILITIES

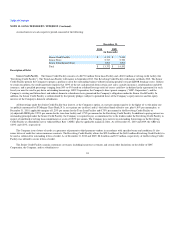

Other long term liabilities at each respective period consisted of the following:

December 31,

2010 2009

(in thousands)

Fair value of interest rate swap agreements $ 3,074 $ 14,679

Liability for unrecognized tax benefits 8,720 6,776

Rent escalations 10,566 10,569

Other 11,590 7,496

Total $ 33,950 $ 39,520

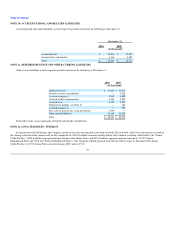

NOTE 14. FINANCIAL INSTRUMENTS

At December 31, 2010 and 2009, the Company's financial instruments consisted of cash and cash equivalents, receivables, franchise notes receivable,

accounts payable, certain accrued liabilities and long-term debt. The carrying amount of cash and cash equivalents, receivables, accounts payable and accrued

liabilities approximates their fair value because of the short maturity of these instruments. Based on the interest rates currently available and their underlying

risk, the carrying value of the franchise notes receivable approximates their fair value. These fair values are reflected net of reserves, which are recognized

according to Company policy. The Company determined the estimated fair values of its debt by using currently available market information and estimates

and assumptions where appropriate. Accordingly, as considerable judgment is required to determine these estimates, changes in the assumptions or

methodologies may have an effect on

97