GNC 2011 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2011 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTE 12. LONG-TERM DEBT / INTEREST (Continued)

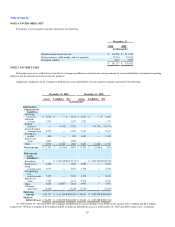

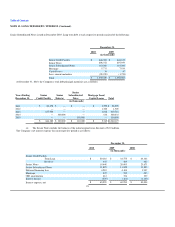

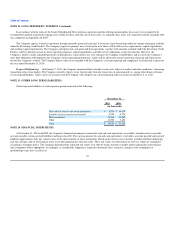

Accrued interest at each respective period consisted of the following:

December 31,

2010 2009

(in thousands)

Senior Credit Facility $ 4,173 $ 5,350

Senior Notes 5,717 5,720

Senior Subordinated Notes 3,482 3,482

Total $ 13,372 $ 14,552

Description of Debt:

Senior Credit Facility. The Senior Credit Facility consists of a $675.0 million Term Loan Facility and a $60.0 million revolving credit facility (the

"Revolving Credit Facility"). The Term Loan Facility will mature in September 2013. The Revolving Credit Facility will mature in March 2012. The Senior

Credit Facility permits the Company to prepay a portion or all of the outstanding balance without incurring penalties (except LIBOR breakage costs). Subject

to certain exceptions, the credit agreement requires that 100% of the net cash proceeds from certain asset sales, casualty insurance, condemnations and debt

issuances, and a specified percentage (ranging from 50% to 0% based on a defined leverage ratio) of excess cash flow (as defined in the agreement) for each

fiscal year must be used to pay down outstanding borrowings. GNC Corporation, the Company's direct parent company ("GNC Corporation"), and the

Company's existing and future direct and indirect domestic subsidiaries have guaranteed the Company's obligations under the Senior Credit Facility. In

addition, the Senior Credit Facility is collateralized by first priority pledges (subject to permitted liens) of the Company's equity interests and the equity

interests of the Company's domestic subsidiaries.

All borrowings under the Senior Credit Facility bear interest, at the Company's option, at a rate per annum equal to (i) the higher of (x) the prime rate

(as publicly announced by JP Morgan Chase Bank, N.A. as its prime rate in effect) and (y) the federal funds effective rate, plus 0.50% per annum plus, at

December 31, 2010, applicable margins of 1.25% per annum for the Term Loan Facility and 0.75% per annum for the Revolving Credit Facility or

(ii) adjusted LIBOR plus 2.25% per annum for the term loan facility and 1.75% per annum for the Revolving Credit Facility. In addition to paying interest on

outstanding principal under the Senior Credit Facility, the Company is required to pay a commitment fee to the lenders under the Revolving Credit Facility in

respect of unutilized revolving loan commitments at a rate of 0.50% per annum. The Company pays interest on outstanding borrowings on the Revolving

Credit Facility at a Eurodollar rate or Adjusted Base Rate ("ABR") plus the applicable margin in effect. As of December 31, 2010 and 2009, the ABR was

4.00% and 4.25%, respectively.

The Company issues letters of credit as a guarantee of payment to third-payment vendors in accordance with specified terms and conditions. It also

issues letters of credit for various insurance contracts. The Revolving Credit Facility allows for $25.0 million of the $60.0 million Revolving Credit Facility to

be used as collateral for outstanding letters of credit. As of December 31, 2010 and 2009, $8.8 million and $7.9 million, respectively, of the Revolving Credit

Facility was utilized to secure letters of credit.

The Senior Credit Facility contains customary covenants, including incurrence covenants and certain other limitations on the ability of GNC

Corporation, the Company, and its subsidiaries to

94