Burger King 2006 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2006 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements Ì (Continued)

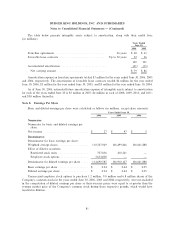

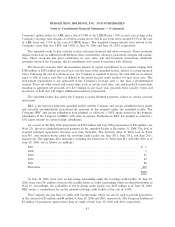

The U.S. Federal tax statutory rate reconciles to the effective tax rate as follows:

Years Ended June 30,

2006 2005 2004

U.S. Federal income tax rateÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 35.0% 35.0% 35.0%

State income taxes, net of federal income tax benefit ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 2.8 2.8 25.2

Benefit and taxes related to foreign operations ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 11.1 (12.2) (28.8)

Foreign exchange differential on tax benefits ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (1.9) 4.8 (87.2)

Change in valuation allowance ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 0.9 10.1 80.4

Change in accrual for tax uncertainties ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 18.4 4.4 33.7

Other ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì (5.2) (13.9)

Effective income tax rate ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 66.3% 39.7% 44.4%

During the year ended June 30, 2006, the Company recorded accruals for tax uncertainties of $15 million

and changes in the estimate of tax provisions of $7 million, which resulted in a higher effective tax rate for the

year.

The income tax expense includes an increase in valuation allowance related to deferred tax assets in

foreign countries of $1 million, $12 million, and $7 million for the years ending June 30, 2006, 2005 and 2004,

respectively. For the year ended June 30, 2005, the valuation allowance decreased by $4 million in certain

states. This reduction was a result of determining that it was more likely than not that certain state loss

carryforwards and other deferred tax assets would be realized. The valuation allowance increased by $1 million

for certain state loss carryforwards as their realization was not considered more likely than not for the year

ended June 30, 2004.

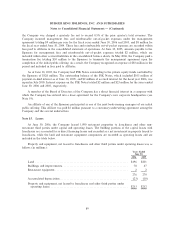

The following table provides the amount of income tax expense (benefit) allocated to continuing

operations and amounts separately allocated to other items (in millions):

Years Ended June 30,

2006 2005 2004

Income tax expense from continuing operations ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 53 $31 $ 4

Interest rate swaps in accumulated other comprehensive income (loss) ÏÏÏÏ 10 Ì Ì

Minimum pension liability in accumulated other comprehensive income

(loss) ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 2 (2) Ì

Adjustments to deferred income taxes related to brand ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (6)

Adjustments to the valuation allowance related to brand (See note 7) ÏÏÏÏÏ (12) Ì (2)

$47 $29 $2

86