Burger King 2006 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2006 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements Ì (Continued)

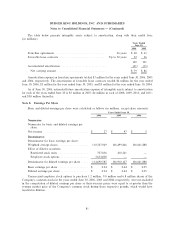

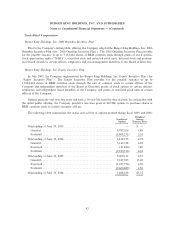

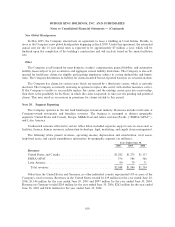

Rent expense associated with the lease commitments is as follows (in millions):

Years Ended

June 30,

2006 2005 2004

Rental expense:

Minimum ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $151 $145 $137

Contingent ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 6 6 5

Amortization of favorable and unfavorable lease contracts, net ÏÏÏÏÏÏÏÏÏÏ (24) (29) (52)

Total rental expenseÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $133 $122 $ 90

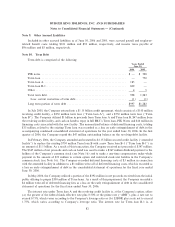

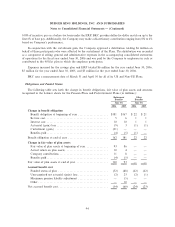

Favorable and unfavorable lease contracts are amortized over a period of up to 20 years and are included

in occupancy and other operating costs and property expenses, respectively, in the consolidated statements of

operations. Amortization of unfavorable lease contracts totaled $28 million for the year ended June 30, 2006,

$32 million for the year ended June 30, 2005, and $57 million for the year ended June 30, 2004. Amortization

of favorable lease contracts totaled $4 million for the year ended June 30, 2006, $3 million for the year ended

June 30, 2005, and $5 million for the year ended June 30, 2004.

Unfavorable leases, net of accumulated amortization totaled $234 million and $261 million at June 30,

2006 and June 30, 2005, respectively. Unfavorable leases, net of amortization are classified within other

deferrals and liabilities in the consolidated balance sheets.

As of June 30, 2006, estimated future amortization expense of unfavorable lease contracts subject to

amortization for each of the years ended June 30 is $26 million in 2007, $24 million in 2008, $22 million in

2009, $21 million in 2010, $19 million in 2011, and $122 million thereafter.

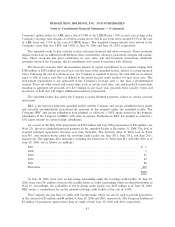

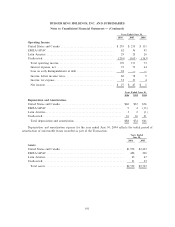

Note 16. Stockholders' equity

Capital Stock

The Company was initially capitalized on December 13, 2002 with $398 million in cash, as a limited

liability company. On June 27, 2003, the Company was converted to a corporation and issued an aggregate

104,692,735 common shares to the private equity funds controlled by the Sponsors.

As described in Note 1, in connection with the initial public offering, the Board of Directors of the

Company authorized an increase in the number of shares of the Company's $0.01 par value common stock to

300 million shares, authorized a 26.34608 to one stock split on common stock and authorized 10 million shares

of a new class of preferred stock, with a par value of $0.01 per share. As of June 30, 2006, no shares of this new

class of preferred stock were issued or outstanding.

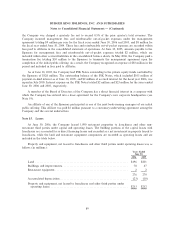

Dividends Paid and Return of Capital

On February 21, 2006, the Company paid a dividend of $367 million, or $3.42 per issued and outstanding

share, to holders of record of the Company's common stock on February 9, 2006, including members of senior

management. The payment of the dividend was financed primarily from proceeds of the amended facility (see

Note 10) and was recorded as a cash dividend of $100 million ($0.93 per share) charged to the Company's

historical cumulative retained earnings through the dividend date, and as a return of capital of $267 million

($2.49 per share) charged to additional paid-in capital in the accompanying consolidated statement of

stockholders' equity and other comprehensive income (loss) for the year ended June 30, 2006.

91