Burger King 2006 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2006 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

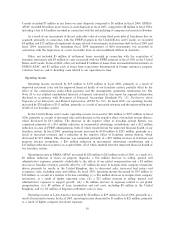

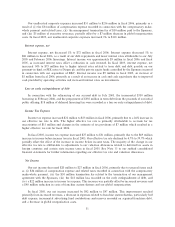

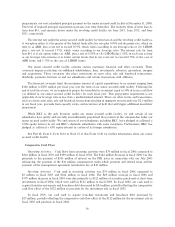

Historically, the most significant ongoing component of our investing activities was for capital expendi-

tures to open new company restaurants, to remodel and maintain restaurant properties to our standards and to

develop our corporate infrastructure in connection with our acquisition of BKC, particularly investment in

information technology. The following table presents capital expenditures, by type of expenditure:

For the

Fiscal Year Ended

June 30,

2006 2005 2004

(In millions)

New restaurants ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $25 $26 $22

Real estate purchases ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 6 5 5

Maintenance capital ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 40 44 43

Other, including corporate ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 14 18 11

Total ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $85 $93 $81

Maintenance capital includes renovations to company restaurants, including restaurants acquired from

franchisees, investments in new equipment and normal annual capital investments for each company

restaurant to maintain its appearance in accordance with our standards, which typically range from $10,000 to

$15,000 per restaurant per year. Maintenance capital also includes investments in improvements to properties

we lease and sublease to franchisees, including contributions we make towards improvements completed by

franchisees. Other capital expenditures include investments in information technology systems, as well as

investments in technologies for deployment in restaurants, such as point-of-sale software.

We expect capital expenditures of approximately $80 to $100 million in fiscal 2007 for maintenance

capital, acquisitions, new restaurants and other corporate expenditures.

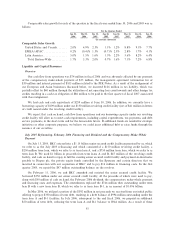

Financing Activities. Financing activities used cash of $173 million in fiscal 2006 and $2 million in fiscal

2005, and provided cash of $3 million in fiscal 2004. Uses of cash in financing activities in fiscal 2006 included

the payment of the $367 million dividend and the net repayment of $186 million in term debt, which were

partially offset by $392 million of proceeds, net of underwriter fees and other costs, received, from our initial

public offering and $7 million of proceeds from the exercise of stock options.

Realignment of our European and Asian businesses

During fiscal 2005, we realigned our business to operate as a global brand by moving to common systems

and platforms, standardizing our marketing efforts, and introducing a uniform product offering supplemented

by offerings targeting local consumer preferences. We also reorganized our international management

structure by instituting a regional structure for the United States and Canada, EMEA/APAC and

Latin America.

To further this initiative, we regionalized the activities associated with managing our European and Asian

businesses, including the transfer of rights of existing franchise agreements, the ability to grant future

franchise agreements and utilization of our intellectual property assets in EMEA/APAC, in new European

and Asian holding companies. Each of these new holding companies is responsible in its region for

(a) management, development and expansion of the Burger King trade names and trademarks,

(b) management of existing and future franchises and licenses for both franchise and company-owned

restaurants, and (c) collections and redeployment of funds. Previously, the intellectual property assets related

to EMEA/APAC were owned by a U.S. company, with the result that all cash flows returned to the

United States and then were subsequently transferred back to these regions to fund their growing capital

requirements. We believe this realignment more closely aligns the intellectual property to the respective

regions, provides funding in the proper regions and will lower our effective tax rate going forward.

The new holding companies acquired the intellectual property rights from BKC, a U.S. company, in a

transaction that generated a taxable gain for BKC in the United States of $328 million, resulting in a

$126 million tax liability in the fourth quarter of 2006 recorded in other accrued liabilities on our consolidated

57