Burger King 2006 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2006 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements Ì (Continued)

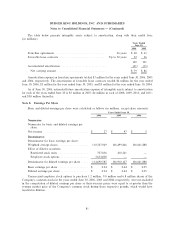

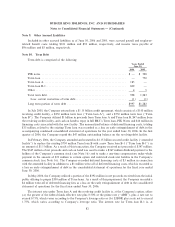

The table below presents intangible assets subject to amortization, along with their useful lives

(in millions):

Years Ended

June 30,

2006 2005

Franchise agreements ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 26 years $ 68 $ 65

Favorable lease contracts ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Up to 20 years 32 36

100 101

Accumulated amortizationÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (21) (15)

Net carrying amount ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 79 $ 86

Amortization expense on franchise agreements totaled $3 million for the years ended June 30, 2006, 2005

and 2004, respectively. The amortization of favorable lease contracts totaled $4 million for the year ended

June 30, 2006, $3 million for the year ended June 30, 2005, and $5 million for the year ended June 30, 2004.

As of June 30, 2006, estimated future amortization expense of intangible assets subject to amortization

for each of the years ended June 30 is $5 million in 2007; $4 million in each of 2008, 2009, 2010, and 2011;

and $58 million thereafter.

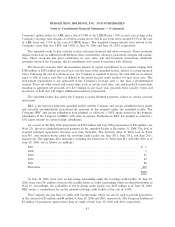

Note 8. Earnings Per Share

Basic and diluted earnings per share were calculated as follows (in millions, except share amounts):

Years Ended June 30,

2006 2005 2004

Numerator:

Numerator for basic and diluted earnings per

share:

Net incomeÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 27 $ 47 $ 5

Denominator:

Denominator for basic earnings per share:

Weighted average shares ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 110,327,949 106,499,866 106,061,888

Effect of dilutive securities:

Restricted stock units ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 707,836 410,261 Ì

Employee stock optionsÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 3,654,800 Ì Ì

Denominator for diluted earnings per share ÏÏÏÏÏ 114,690,585 106,910,127 106,061,888

Basic earnings per share ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 0.24 $ 0.44 $ 0.05

Diluted earnings per share ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 0.24 $ 0.44 $ 0.05

Unexercised employee stock options to purchase 1.2 million, 9.0 million and 6.8 million shares of the

Company's common stock for the years ended June 30, 2006, 2005 and 2004, respectively, were not included

in the computation of diluted earnings per share as their exercise prices were equal to or greater than the

average market price of the Company's common stock during those respective periods, which would have

resulted in dilution.

81