Burger King 2006 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2006 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Our impairment test for indefinite-lived intangible assets consists of a comparison of the fair value of the asset

with its carrying amount in each segment, as defined by SFAS No. 131, which are the United States and

Canada, EMEA/APAC, and Latin America. When assessing the recoverability of these assets, we make

assumptions regarding estimated future cash flow similar to those when testing long-lived assets, as described

above. In the event that our estimates or related assumptions change in the future, we may be required to

record an impairment charge in accordance with SFAS No. 142, Goodwill and Other Intangible Assets.

Reserves for Uncollectible Accounts and Revenue Recognition

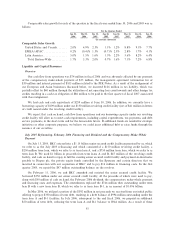

We collect from franchisees royalties, advertising fund contributions and, in the case of approximately 5%

of our franchise restaurants, rents. We recognize revenue that is estimated to be reasonably assured of

collection, and also record reserves for estimated uncollectible revenues and advertising contributions, based

on monthly reviews of franchisee accounts, average sales trends, and overall economic conditions. In the event

that franchise restaurant sales declined, or the financial health of franchisees otherwise deteriorated, we

increase our reserves for uncollectible accounts and/or defer or not recognize revenues, the collection of which

we deem to be less than reasonably assured.

Accounting for Income Taxes

We record income tax liabilities utilizing known obligations and estimates of potential obligations. A

deferred tax asset or liability is recognized whenever there are future tax effects from existing temporary

differences and operating loss and tax credit carryforwards. When considered necessary, we record a valuation

allowance to reduce deferred tax assets to the balance that is more likely than not to be realized. We make

estimates and judgments on future taxable income, considering feasible tax planning strategies and taking into

account existing facts and circumstances, to determine the proper valuation allowance. When we determine

that deferred tax assets could be realized in greater or lesser amounts than recorded, the asset balance and

income statement reflects the change in the period such determination is made. Due to changes in facts and

circumstances and the estimates and judgments that are involved in determining the proper valuation

allowance, differences between actual future events and prior estimates and judgments could result in

adjustments to this valuation allowance.

We use an estimate of the annual effective tax rate at each interim period based on the facts and

circumstances available at that time, while the actual effective tax rate is calculated at fiscal year-end.

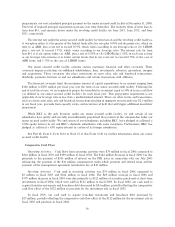

Self-Insurance Programs

We are self-insured for most workers' compensation, health care claims, and general liability losses.

These self-insurance programs are supported by third-party insurance policies to cover losses above our self-

insured amounts. We record estimates of insurance liabilities based on independent actuarial studies and

assumptions based on historical and recent claim cost trends and changes in benefit plans that could affect

self-insurance liabilities. We review all self-insurance reserves at least quarterly, and review our estimation

methodology and assumptions at least annually. If we determine that the liability exceeds the recorded

obligation, the cost of self-insurance programs will increase in the future, as insurance reserves are increased to

revised expectations, resulting in an increase in self-insurance program expenses.

We have claims for certain years which are insured by a third party carrier, which is currently insolvent.

We are currently reviewing our options to replace this carrier with another insurance carrier. If we are unable

to successfully replace the carrier and the existing carrier goes into receivership, then there is the possibility for

the State in which the claim is reported to take over the pending and potential claims. This may result in an

increase in premiums for claims related to this period.

Newly Issued Accounting Standards

In December 2004, the FASB issued Statement No. 123 (revised 2004), Share-Based Payment

(""SFAS No. 123(R)''), which is a revision of FASB Statement No. 123, Accounting for Stock-Based

Compensation (""SFAS No. 123''). SFAS No. 123(R) supersedes Accounting Principles Board Opinion

62