Burger King 2006 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2006 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements Ì (Continued)

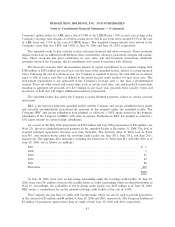

Company's option, either (a) ABR, plus a rate of 0.50% or (b) LIBOR plus 1.50%, in each case so long as the

Company's leverage ratio remains at or below certain levels (but in any event not to exceed 0.75% in the case

of ABR loans and 1.75% in the case of LIBOR loans). The weighted average interest rates related to the

Company's term debt was 5.89% and 5.40% at June 30, 2006 and June 30, 2005, respectively.

The amended credit facility contains certain customary financial and other covenants. These covenants

impose restrictions on additional indebtedness, liens, investments, advances, guarantees, mergers and acquisi-

tions. These covenants also place restrictions on asset sales, sale and leaseback transactions, dividends,

payments between the Company and its subsidiaries and certain transactions with affiliates.

The financial covenants limit the maximum amount of capital expenditures to an amount ranging from

$180 million to $250 million per fiscal year over the term of the amended facility, subject to certain financial

ratios. Following the end of each fiscal year, the Company is required to prepay the term debt in an amount

equal to 50% of excess cash flow (as defined in the senior secured credit facility) for such fiscal year. This

prepayment requirement is not applicable if the Company's leverage ratio is less than a predetermined

amount. There are other events and transactions, such as certain asset sales, sale and leaseback transactions

resulting in aggregate net proceeds over $2.5 million in any fiscal year, proceeds from casualty events and

incurrence of debt that will trigger additional mandatory prepayment.

The amended facility also allows the Company to make dividend payments, subject to certain covenant

restrictions.

BKC is the borrower under the amended facility and the Company and certain subsidiaries have jointly

and severally unconditionally guaranteed the payment of the amounts under the amended facility. The

Company, BKC and certain subsidiaries have pledged, as collateral, a 100% equity interest in the domestic

subsidiaries of the Company and BKC with some exceptions. Furthermore, BKC has pledged as collateral a

65% equity interest in certain foreign subsidiaries.

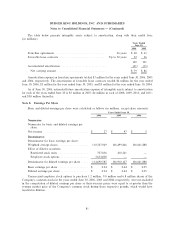

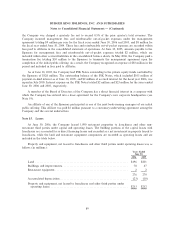

As a result of the May 2006 prepayment of $350 million and July 2006 prepayment of $50 million (see

Note 23), the next scheduled principal payment on the amended facility is December 31, 2008. The level of

required principal repayments increases over time thereafter. The maturity dates of Term loan A, Term

loan B-1, and amounts drawn under the revolving credit facility are June 2011, June 2012, and June 2011,

respectively. The aggregate debt maturities, including the Term loan A, Term loan B-1 and other debt as of

June 30, 2006, are as follows (in millions):

2007ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 1

2008ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 1

2009ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 35

2010ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 63

2011ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 88

Thereafter ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 810

$998

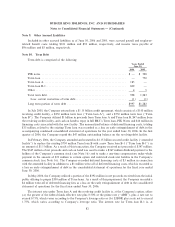

At June 30, 2006, there were no borrowings outstanding under the revolving credit facility. At June 30,

2006, there were $41 million of irrevocable standby letters of credit outstanding, which are described further in

Note 19. Accordingly, the availability of the revolving credit facility was $109 million as of June 30, 2006.

BKC incurs a commitment fee on the unused revolving credit facility at the rate of 0.50%.

The Company also has lines of credits with foreign banks, which can also be used to provide guarantees,

in the amounts of $5 million and $4 million at June 30, 2006 and 2005, respectively. The Company had issued

$2 million of guarantees against these lines of credit at both June 30, 2006 and 2005, respectively.

83