Burger King 2006 Annual Report Download - page 60

Download and view the complete annual report

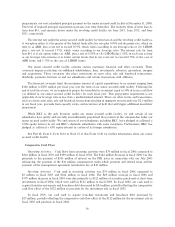

Please find page 60 of the 2006 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.of nine new company restaurant openings since June 30, 2005. Payroll and employee benefits costs increased

0.9% to 12.5% of company restaurant revenues in Latin America. In fiscal 2005, payroll and employee benefits

costs increased 12% to $6 million, primarily as a result of new company restaurants. Payroll and employee

benefits costs were 11.4% of company restaurant revenues in Latin America in fiscal 2005, compared to 11.0%

in fiscal 2004.

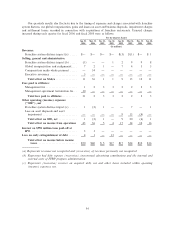

Occupancy and other operating costs increased 11% to $380 million in fiscal 2006. Occupancy and other

operating costs were 25.1% of company restaurant revenues in fiscal 2006 compared to 24.4% in fiscal 2005.

These increases are primarily attributable to the acquisition of franchise restaurants and increased utility costs.

Occupancy and other operating costs increased 9% to $343 million in fiscal 2005, primarily as a result of

the acquisition of franchise restaurants and increases in costs such as rents and utilities. Occupancy and other

operating costs were 24.4% of company restaurant revenues in fiscal 2005 compared to 24.6% in fiscal 2004,

primarily because of sales growth.

In the United States and Canada, occupancy and other operating costs increased to 24.1% of company

restaurant revenues in fiscal 2006 compared to 23.6% in fiscal 2005, primarily as a result of increased utility

and restaurant supply costs. In fiscal 2005, occupancy and other operating costs were 23.6% of company

restaurant revenues compared to 26.1% in fiscal 2004, primarily as a result of leveraging base rents from

increased sales.

In EMEA/APAC, occupancy and other operating costs increased to 27.3% of company restaurant

revenues in fiscal 2006 compared to 26.1% in fiscal 2005, as a result of decreased restaurant sales, increased

utilities in the segment and increased rents in the United Kingdom, partially offset by the closure of certain

restaurants with higher than average restaurant rents. In fiscal 2005, occupancy and other operating costs were

26.1% of company restaurant revenues compared to 22.9% in fiscal 2004, primarily as a result of increased

rents and utilities in the United Kingdom and adjustments we recorded in fiscal 2004 when we finalized our

purchase accounting allocations.

In Latin America, occupancy and other operating costs increased to 25% of company restaurant revenues

in fiscal 2006 from 21.6% in fiscal 2005, primarily as a result of a decrease in comparable sales and increased

utility costs. In fiscal 2005, occupancy and other operating costs were 21.6% of company restaurant revenues

compared to 13.7% in fiscal 2004, primarily as a result of increased utility costs and adjustments we recorded

in fiscal 2004 when we finalized our purchase accounting allocations.

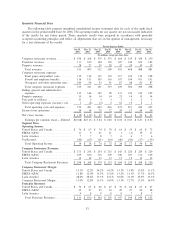

Worldwide selling, general and administrative expenses

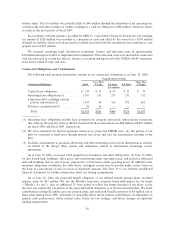

Selling, general and administrative expenses increased by $1 million to $488 million during fiscal 2006.

General and administrative expenses increased $17 million to $416 million, while selling expenses decreased

$16 million to $72 million.

Our fiscal 2006 general and administrative expenses included $34 million of compensation expense and

taxes related to the compensatory make-whole payment, $10 million in expenses associated with the

realignment of our European and Asian businesses and $5 million of executive severance expense. Addition-

ally, our acquisition of 44 franchise restaurants (net of refranchisings) resulted in increased general and

administrative expenses related to the management of our company restaurants. Partially offsetting these

increased expenses was a $19 million reduction in general and administrative expenses related to franchise

system distress and our global reorganization costs in fiscal 2006.

The $16 million decrease in selling expenses in fiscal 2006 is primarily attributable to a $14 million

decrease in incremental advertising expense compared to fiscal 2005 resulting from franchisee non-payment of

advertising contributions. Partially offsetting this reduction were incremental advertising expenses for

company restaurants opened or acquired in fiscal 2006.

In fiscal 2005, selling, general and administrative expenses increased $13 million to $487 million. General

and administrative costs increased 10% to $399 million, while selling expenses decreased 21% to $88 million.

48