Burger King 2006 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2006 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements Ì (Continued)

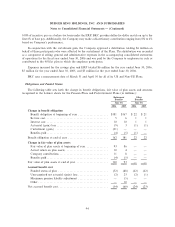

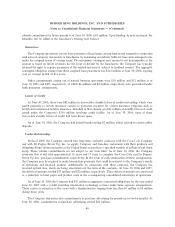

The weighted-average assumptions used in computing the net periodic benefit cost of the U.S. Pension

Plans (retirement benefits) and Postretirement Plans (other benefits) are as follows:

Retirement Benefits Other Benefits

Years Ended June 30, Years Ended June 30,

2006 2005 2004 2006 2005 2004

Discount rate ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 5.86% 6.00% 6.25% 5.86% 6.00% 6.25%

Range of compensation rate increaseÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 4.75% 4.75% 4.75% 0.00% 0.00% 0.00%

Expected long-term rate of return on plan assetsÏÏÏÏ 8.75% 8.75% 8.75% 0.00% 0.00% 0.00%

The expected long-term rate of return on plan assets is determined by expected future returns on the asset

categories in target investment allocation. These expected returns are based on historical returns for each

asset's category adjusted for an assessment of current market conditions.

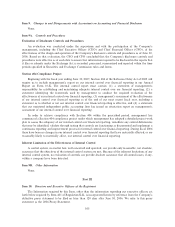

The assumed healthcare cost trend rates are as follows:

Years Ended June 30,

2006 2005 2004

Healthcare cost trend rate assumed for next year ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 10.00% 9.00% 9.50%

Rate to which the cost trend rate is assumed to decline (the ultimate

trend rate) ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 5.00% 5.00% 5.00%

Year that the rate reaches the ultimate trend rateÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 2016 2013 2013

Assumed healthcare cost trend rates do not have a significant effect on the amounts reported for the

postretirement healthcare plans, since a one-percentage point change in the assumed healthcare cost trend

rate would have very minimal effects on service and interest cost and the postretirement obligation.

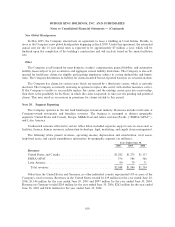

Plan Assets

The fair value of plan assets for BKC's U.S. pension benefit plans as of March 31, 2006 and 2005 was

$95 million and $82 million, respectively. The fair value of plan assets for BKC's pension benefit plans outside

the U.S. was $15 million and $11 million at April 30, 2006 and 2005, respectively.

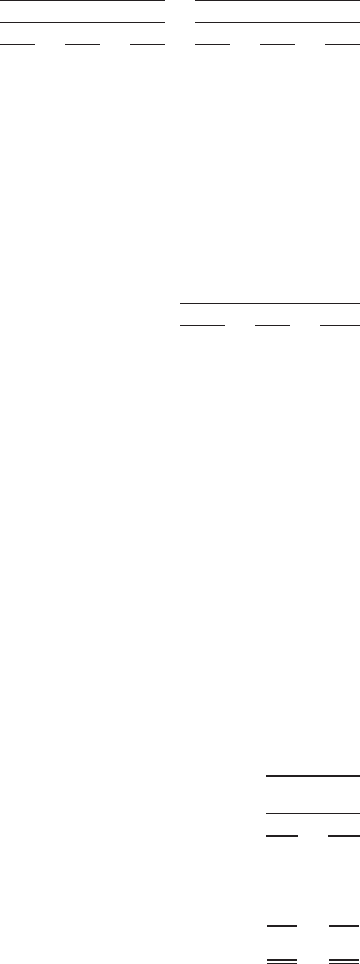

The following table sets forth the asset allocation for BKC's U.S. pension plans' assets:

Retirement

Benefits

Years Ended

June 30,

2006 2005

Equity securities ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 72% 71%

Debt securitiesÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 27% 28%

Short-term investments ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 1% 1%

100% 100%

The investment objective for the U.S. pension plans is to secure the benefit obligations to participants

while minimizing costs to the Company. The goal is to optimize the long-term return on plan assets at an

average level of risk. The target investment allocation is 65% equity and 35% fixed income securities. The

portfolio of equity securities includes primarily large-capitalization U.S. companies with a mix of some small-

capitalization U.S. companies and international entities.

96