Burger King 2006 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2006 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.BURGER KING HOLDINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements Ì (Continued)

comprised of unrealized gains and losses on foreign currency translation adjustments, unrealized gain on

hedging activity, net of tax, and minimum pension liability adjustments, net of tax.

Derivative Financial Instruments

SFAS No. 133, Accounting for Derivative Instruments and Hedging Activities, as amended, establishes

accounting and reporting standards for derivative instruments and for hedging activities by requiring that all

derivatives be recognized in the balance sheet and measured at fair value. Gains or losses resulting from

changes in the fair value of derivatives are recognized in earnings or recorded in other comprehensive income

(loss) and recognized in the statement of operations when the hedged item affects earnings, depending on the

purpose of the derivatives and whether they qualify for hedge accounting treatment.

When applying hedge accounting, the Company's policy is to designate, at a derivative's inception, the

specific assets, liabilities or future commitments being hedged, and to assess the hedge's effectiveness at

inception and on an ongoing basis. The Company may not designate the derivative as a hedging instrument

where the same financial impact is achieved in the financial statements. The Company does not enter into or

hold derivatives for trading or speculative purposes.

Disclosures About Fair Value of Financial Instruments

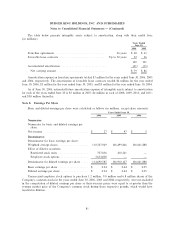

Cash and cash equivalents, trade and notes receivable: The carrying value equals fair value based on the

short-term nature of these accounts.

Debt, including current maturities: The carrying value of term debt was $998 million at June 30, 2006

and $1.28 billion at June 30, 2005 which approximated fair value as the debt at both of these dates carry a

floating interest rate and reflect the Company's credit ratings at each date.

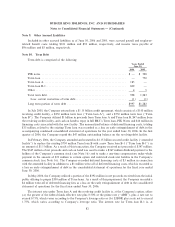

Revenue Recognition

Revenues include retail sales at Company-owned restaurants and franchise and property revenues.

Franchise and property revenues include royalties, initial and renewal franchise fees, and property revenues,

which include pass-through rental income from operating lease rentals and earned income on direct financing

leases on property leased to franchisees. Retail sales are recognized at the point of sale. Royalties are based on

a percentage of sales by franchisees. Royalties are recorded as earned and when collectibility is reasonably

assured. Initial franchise fees are recognized as income when the related restaurant begins operations. A

franchisee may pay a renewal franchise fee and renew its franchise for an additional term. Renewal franchise

fees are recognized as income upon receipt of the non-refundable fee and execution of a new franchise

agreement. In accordance with SFAS No. 45, Accounting for Franchise Fee Revenue, the cost recovery

accounting method is used to recognize revenues for franchisees for whom collectibility is not reasonably

assured.

Pass-through rental income on operating lease rentals and earned income on direct financing leases are

recognized as earned and when collectibility is reasonably assured.

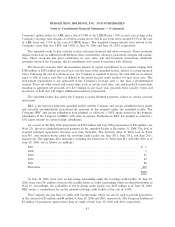

Advertising and Promotional Costs

The Company expenses the production costs of advertising when the advertisements are first aired or

displayed. All other advertising and promotional costs are expensed in the period incurred, in accordance with

Statement of Position (""SOP'') No. 93-7, Reporting on Advertising Costs.

Franchised restaurants and Company-owned restaurants contribute to advertising funds managed by the

Company in the United States and certain international markets where Company-owned restaurants operate.

Under the Company's franchise agreements, contributions received from franchisees must be spent on

76