Burger King 2006 Annual Report Download - page 83

Download and view the complete annual report

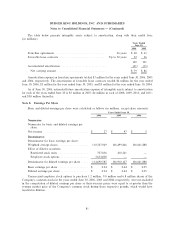

Please find page 83 of the 2006 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.BURGER KING HOLDINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

Note 1. Description of Business and Organization

Description of Business

Burger King Holdings, Inc. (""BKH'' or the ""Company'') is a Delaware corporation formed on July 23,

2002. It is the parent of Burger King Corporation (""BKC''), a Florida corporation that franchises and operates

fast food hamburger restaurants, principally under the Burger King brand. BKH is approximately 75.9% owned

by private equity funds controlled by Texas Pacific Group, the Goldman Sachs Capital Funds and Bain

Capital Partners (collectively, the ""Sponsors'').

The Company generates revenues from three sources: (i) sales at restaurants owned by the Company;

(ii) royalties and franchise fees paid by franchisees; and (iii) property income from the franchise restaurants

that the Company leases or subleases to franchisees. The Company receives monthly royalties and advertising

contributions from franchisees based on a percentage of restaurant sales.

Organization

On December 13, 2002 (the ""Transaction Date''), Gramet Holding Corporation (""GHC''), a wholly-

owned subsidiary of Diageo plc and the former parent of BKC, completed its sale of 100% of the outstanding

common stock of BKC to Burger King Acquisition Corporation (""BKAC'') for $1.51 billion, subject to

adjustments (the ""Transaction'').

BKAC was established as an acquisition vehicle by the Sponsors for the purpose of acquiring BKC.

BKAC was capitalized with an $822.5 million capital contribution from BKH. Of the aggregate contribution,

$610 million was paid in cash and $212.5 million was due from the Company.

On the Transaction Date, BKAC paid GHC a total of $1,404.3 million, calculated as $1,510 million less a

preliminary purchase price adjustment of $105.7 million. The Company and GHC ultimately settled on a

further reduction to the purchase price of $5 million. Of the total amount, GHC received $441.8 million in

cash from BKAC, $750 million in loan proceeds from BKAC's lenders and $212.5 million in the form of a

payment-in-kind note, or PIK note, issued by BKH to GHC. Additionally, BKAC paid $62.5 million in costs

associated with the Transaction, comprised of $28.8 million in deferred financing fees and $33.7 in

professional fees. Of the $33.7 in professional fees, $22.4 million was paid to the Sponsors.

On the Transaction Date, BKH also issued PIK notes in the aggregate amount of $212.5 million to the

private equity funds controlled by the Sponsors, and the proceeds were contributed to BKAC. The terms of

these PIK notes were identical to the PIK note issued to GHC.

BKAC was merged into BKC upon completion of the Transaction. The merger was accounted for as a

combination of entities under common control.

The Transaction was accounted for using the purchase method of accounting, or purchase accounting, in

accordance with Statement of Financial Accounting Standard (""SFAS'') No. 141, Business Combinations

(""SFAS No. 141''). At the time of the Transaction, the Company made a preliminary allocation of the

purchase price to the assets acquired and liabilities assumed at their estimated fair market value. After the

transaction, the Company hired a third party valuation firm to assist in determining the fair market value of

the assets. In December 2003, the Company completed its fair market value calculations and finalized the

purchase accounting adjustments to these preliminary allocations. The sum of the fair value of assets acquired

and liabilities assumed exceeded the acquisition cost, resulting in negative goodwill of $154 million. The

negative goodwill was allocated on a pro rata basis to reduce the carrying value of long-lived assets in

accordance with SFAS No. 141.

In connection with the final allocation of the purchase price, the Company adjusted the valuation of its

long-lived assets, primarily property and equipment, and recorded favorable and unfavorable leases as

71