Burger King 2006 Annual Report Download - page 54

Download and view the complete annual report

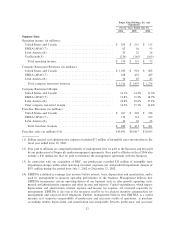

Please find page 54 of the 2006 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.fiscal 2006 and 62 (net of closures) during fiscal 2005, increasing our total system restaurant count in this

segment to 808 at June 30, 2006.

Factors Affecting Comparability of Results

Purchase Accounting

The acquisition of BKC was accounted for using the purchase method of accounting, or purchase

accounting, in accordance with Financial Accounting Standards Board (""FASB'') Statement of Financial

Accounting Standards (""SFAS'') No. 141, Business Combinations. Purchase accounting required a prelimi-

nary allocation of the purchase price to the assets acquired and liabilities assumed at their estimated fair

market values at the time of our acquisition of BKC. In December 2003, we completed our fair market value

calculations and finalized the adjustments to these preliminary purchase accounting allocations. As part of

finalizing our assessment of fair market values, we reviewed all of our lease agreements worldwide. Some of

our lease payments were at below-market lease rates while other lease payments were at above-market lease

rates. In cases where we were making below-market lease payments, we recorded an asset reflecting this

favorable lease. We amortize this intangible asset over the underlying lease term, which has the effect of

increasing our rent expense on a non-cash basis to the market rate. Conversely, in cases where we were making

above-market lease payments, we recorded a liability reflecting this unfavorable lease. We amortize this

liability over the underlying lease term, which has the effect of decreasing our rent expense on a non-cash

basis to the market rate.

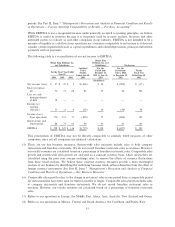

During fiscal 2006, fiscal 2005 and fiscal 2004, we recorded a net benefit from favorable and unfavorable

lease amortization of $24 million, $29 million and $52 million, respectively. The fiscal 2004 unfavorable and

favorable benefit was higher than fiscal 2005 primarily as a result of final adjustments to our purchase price

allocation which resulted in a higher benefit of $19 million associated with favorable and unfavorable lease

amortization. The favorable and unfavorable lease benefit and other miscellaneous adjustments were partially

offset by $18 million of incremental depreciation expense, resulting in a net benefit of $2 million in fiscal 2004,

when we finalized our purchase accounting allocations.

In addition to the amortization of these favorable and unfavorable leases, purchase accounting resulted in

certain other items that affect the comparability of the results of operations, including changes in asset

carrying values (and related depreciation and amortization), expenses related to incurring the debt that

financed the acquisition that were capitalized and amortized as interest expense, and the recognition of

intangible assets (and related amortization).

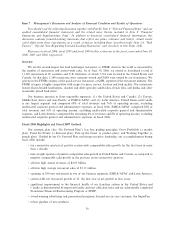

Historical Franchisee Financial Distress

Subsequent to our acquisition of BKC, we began to experience delinquencies in payments of royalties,

advertising fund contributions and rents from certain franchisees in the United States and Canada. In

February 2003, we initiated the FFRP program designed to proactively assist franchisees experiencing

financial difficulties due to over-leverage and other factors including weak sales, the impact of competitive

discounting on operating margins and poor cost management. Under the FFRP program, we worked with

those franchisees with strong operating track records, their lenders and other creditors to attempt to strengthen

the franchisees' financial condition. The FFRP program also resulted in closing unviable franchise restaurants

and our acquisition of certain under-performing franchise restaurants in order to improve their performance.

In addition, we entered into agreements to defer certain royalty payments, which we did not recognize as

revenue during fiscal 2004, and acquired a limited amount of franchisee debt, often as part of broader

agreements to acquire franchise restaurants or real estate. We also contributed funds to cover shortfalls in

franchisee advertising contributions. See ""Other Commercial Commitments and Off-Balance Sheet Arrange-

ments'' for further information about the support we committed to provide in connection with the FFRP

program, including an aggregate remaining commitment of $36 million to fund certain loans to renovate

franchise restaurants, to make renovations to certain restaurants that we lease or sublease to franchisees, and

to provide rent relief and/or contingent cash flow subsidies to certain franchisees. Through this program, we

42