Burger King 2006 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2006 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

150 holders of record of our common stock. From May 18, 2006 through June 30, 2006, our common stock

had a high trading price of $19.45 and a low trading price of $15.48. There were no repurchases of our

common stock by or on behalf of us during the fourth quarter of fiscal 2006 and we do not have a formal or

publicly announced stock repurchase program. The Bank of New York is the transfer agent and registrar of

our common stock.

Recent Sales of Unregistered Securities

In January 2006, the Company issued 46,212 shares of its common stock to a director of the Company for

an aggregate of $1,000,000 in a private placement. In addition, during the 2006 fiscal year the Company issued

an aggregate of 29,746 shares of common stock to certain employees in settlement of restricted stock unit

awards in consideration of services rendered. During the same period, the Company issued an aggregate of

1,247,789 shares of its common stock to employees pursuant to the exercise of outstanding options for an

aggregate of $6,089,377 in consideration of services rendered. These issuances were deemed exempt from

registration under the Securities Act of 1933, as amended, pursuant to Section 4(2) of the Securities Act or

Rule 701 thereunder. In accordance with Rule 701, the shares were issued pursuant to a written compensatory

benefit plan and the issuances did not, during the fiscal year, exceed 15% of the outstanding shares of the

Company's common stock, calculated in accordance with the provisions of Rule 701.

Dividend Policy

On February 21, 2006, we paid an aggregate cash dividend of $367 million to holders of record of our

common stock on February 9, 2006. We currently do not plan to declare further dividends on shares of our

common stock in the near future. We intend to retain our future earnings for use in the operation and

expansion of our business.

Securities Authorized for Issuance Under Equity Compensation Plans

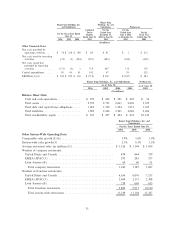

The following table presents information regarding options outstanding under our compensation plans as

of June 30, 2006.

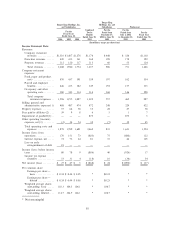

Number of Securities

to be Issued Upon Weighted-Average

Exercise of Exercise Price of Number of Securities

Outstanding Options, Outstanding Options, Remaining Available

Warrants and Rights Warrants and Rights for Future Issuance

(a) (b) (c)

Plan Category

Equity Compensation Plans

Approved by Security Holders:

Burger King Holdings, Inc. 2006

Omnibus Incentive Plan ÏÏÏÏÏÏÏÏ 226,634 $17.13 6,886,808

Burger King Holdings, Inc.

Amended and Restated Equity

Incentive Plan ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 8,138,991 $ 7.62 5,545,427

Equity Compensation Plans Not

Approved by Security Holders ÏÏÏ Ì Ì

TOTAL ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 8,365,625 $ 7.88 12,432,235

Use of Proceeds from Sale of Registered Securities

On May 18, 2006, we commenced our initial public offering of our common stock, par value of $0.01,

pursuant to our Registration Statement on Form S-1, as amended (Reg. No. 333-131897) that was declared

effective on May 17, 2006. We registered 28,750,000 shares of Common Stock at a maximum offering price of

$488.8 million pursuant to the registration statement, all of which were sold in the offering at a per share price

of $17.00 for an aggregate offering price of $488.8 million. The selling shareholders sold 3,750,000 shares and

28