Burger King 2006 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2006 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.BURGER KING HOLDINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements Ì (Continued)

For the year ended June 30, 2004, the Company recognized a charge of $3 million for settlement of a

claim in Australia by BKC's joint venture partner. Under the terms of a settlement agreement, BKC paid

$3 million to terminate certain development rights granted to the joint venture in June 2002. BKC's joint

venture partner also had the option to buy BKC's interest in the joint venture for approximately $6 million by

giving notice to BKC on or before June 30, 2006. The joint venture partner exercised its option and purchased

BKC's interest in the joint venture in August 2006. In addition, BKC agreed to forgive the note receivable

from the joint venture plus accrued interest and accordingly, the Company recognized an impairment loss of

$7 million for the year ended June 30, 2004.

(Recovery) Impairment of Investment in Franchisee Debt

The Company assesses impairment on franchise debt in accordance with SFAS No. 114. For the year

ended June 30, 2004, the Company assessed the collectibility of certain acquired franchisee third-party debt,

and recorded an impairment charge of $12 million. As noted above, for the year ended June 30, 2004, the

Company agreed to forgive the note receivable from the Australia joint venture partner plus accrued interest

and thus the Company recognized an impairment loss of $7 million. There were no impairments for the year

ended June 30, 2006 and 2005.

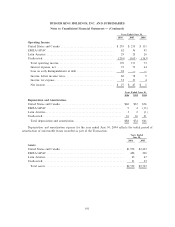

Other, net

Items included within Other, net in fiscal 2005 include settlement losses in connection with the

acquisition of franchise restaurants of $5 million and $5 million of costs associated with the FFRP program.

Items in Other, net in fiscal 2004 include losses from unconsolidated investments of $3 million in EMEA/

APAC and $2 million each of losses from transactions denominated in foreign currencies, property valuation

reserves and re-branding costs related to our operations in Asia.

Note 19. Commitments and Contingencies

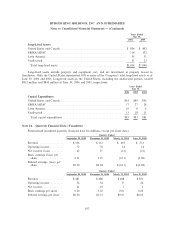

Franchisee Restructuring Program

During 2003, the Company initiated a program designed to provide assistance to franchisees in the

United States and Canada experiencing financial difficulties. Under this program, the Company worked with

franchisees meeting certain operational criteria, their lenders, and other creditors to attempt to strengthen the

franchisees' financial condition. As part of this program, the Company has agreed to provide financial support

to certain franchisees.

In order to assist certain franchisees in making capital improvements to restaurants in need of

remodeling, the Company provided commitments to fund capital expenditure loans (""Capex Loans'') and to

make capital expenditures related to restaurant properties that the Company leases to franchisees. Capex

Loans are typically unsecured, bear interest, and have 10-year terms. Through June 30, 2006, the Company

has funded $3 million in Capex Loans and has made $7 million of improvements to restaurant properties that

the Company leases to franchisees in connection with these commitments. As of June 30, 2006, the Company

has commitments remaining to provide future Capex Loans of $10 million and to make up to $12 million of

improvements to properties that the Company leases to franchisees.

The Company provided $2 million and $3 million of temporary reductions in rent (""rent relief'') for

certain franchisees that leased restaurant property from the Company in the fiscal years ended June 30, 2006

and 2005, respectively. There was no rent relief provided in the fiscal year ended 2004. As of June 30, 2006,

the Company has commitments remaining to provide future rent relief of up to $9 million.

Contingent cash flow subsidies represent commitments by the Company to provide future cash grants to

certain franchisees for limited periods in the event of failure to achieve their debt service coverage ratio. No

contingent cash flow subsidy has been provided through June 30, 2006. The maximum contingent cash flow

98