Burger King 2006 Annual Report Download - page 63

Download and view the complete annual report

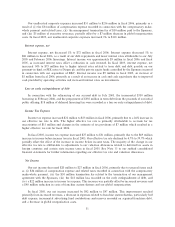

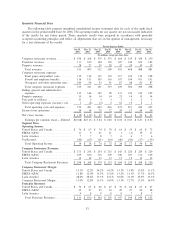

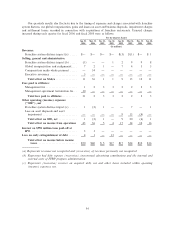

Please find page 63 of the 2006 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Our unallocated corporate expenses increased $51 million to $216 million in fiscal 2006, primarily as a

result of (i) the $34 million of compensation expense recorded in connection with the compensatory make-

whole payment and related taxes, (ii) the management termination fee of $30 million paid to the Sponsors,

and (iii) $5 million of executive severance, partially offset by a $7 million decrease in global reorganization

costs. In fiscal 2005, our unallocated corporate expenses increased 1% to $165 million.

Interest expense, net

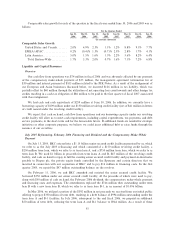

Interest expense, net decreased 1% to $72 million in fiscal 2006. Interest expense decreased 1% to

$81 million in fiscal 2006, as a result of our debt repayments and lower interest rates attributable to our July

2005 and February 2006 financings. Interest income was approximately $9 million in fiscal 2006 and fiscal

2005, as increased interest rates offset a reduction in cash invested. In fiscal 2005, interest expense, net

increased 14% to $73 million due to higher interest rates related to term debt and debt payable on our

payment-in-kind, or PIK notes to Diageo plc and the private equity funds controlled by the Sponsors incurred

in connection with our acquisition of BKC. Interest income was $9 million in fiscal 2005, an increase of

$5 million from fiscal 2004, primarily as a result of an increase in cash and cash equivalents due to improved

cash provided by operating activities and increased interest rates on investments.

Loss on early extinguishment of debt

In connection with the refinancing of our secured debt in July 2005, the incremental $350 million

borrowing in February 2006, and the prepayment of $350 million in term debt from the proceeds of our initial

public offering, $18 million of deferred financing fees were recorded as a loss on early extinguishment of debt.

Income Tax Expense

Income tax expense increased $22 million to $53 million in fiscal 2006, primarily due to a 26% increase in

our effective tax rate to 66%. The higher effective tax rate is primarily attributable to accruals for tax

uncertainties of $15 million and changes in the estimate of tax provisions of $7 million which resulted in a

higher effective tax rate for fiscal 2006.

In fiscal 2005, income tax expense increased $27 million to $31 million, primarily due to the $69 million

increase in income before income taxes in fiscal 2005. Our effective tax rate declined by 4.7% to 39.7% which

partially offset the effect of the increase in income before income taxes. The majority of the change in our

effective tax rate is attributable to adjustments to our valuation allowances related to deferred tax assets in

foreign countries and certain state income taxes in fiscal 2005. See Note 13 to our audited consolidated

financial statements for further information regarding our effective tax rate and valuation allowances.

Net Income

Our net income decreased $20 million to $27 million in fiscal 2006, primarily due to unusual items such

as (i) $34 million of compensation expense and related taxes recorded in connection with the compensatory

make-whole payment, (ii) the $30 million termination fee related to the termination of our management

agreement with the Sponsors, (iii) the $18 million loss recorded on the early extinguishment of debt, and

(iv) a $22 million increase in income tax expense. This increase was partially offset by increased revenues and

a $40 million reduction in costs of franchise system distress and our global reorganization.

In fiscal 2005, our net income increased by $42 million to $47 million. This improvement resulted

primarily from increased revenues, a decrease in expenses related to franchise system distress, particularly bad

debt expense, incremental advertising fund contributions and reserves recorded on acquired franchisee debt,

and a decrease in global reorganization costs.

51