Burger King 2006 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2006 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements Ì (Continued)

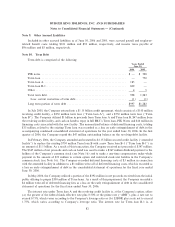

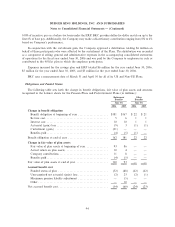

the Company was charged a quarterly fee not to exceed 0.5% of the prior quarter's total revenues. The

Company incurred management fees and reimbursable out-of-pocket expenses under the management

agreement totaling $9 million per year for the fiscal years ended June 30, 2006 and 2005, and $8 million for

the fiscal year ended June 30, 2004. These fees and reimbursable out-of-pocket expenses are recorded within

fees paid to affiliates in the consolidated statement of operations. At June 30, 2005, amounts payable to the

Sponsors for management fees and reimbursable out-of-pocket expenses totaled $2 million, which are

included within other accrued liabilities in the consolidated balance sheets. In May 2006, the Company paid a

termination fee totaling $30 million to the Sponsors to terminate the management agreement upon the

completion of the initial public offering. As a result, the Company recognized an expense of $30 million in the

period and included in fees paid to affiliates.

As of June 30, 2005, the Company had PIK Notes outstanding to the private equity funds controlled by

the Sponsors of $528 million. The outstanding balance of the PIK Notes, which included $103 million of

payment-in-kind interest as of June 30, 2005, and $2 million of accrued interest for the fiscal year 2006, was

repaid in July 2005. Interest expense on the PIK Notes totaled $2 million and $23 million for the years ended

June 30, 2006 and 2005, respectively.

A member of the Board of Directors of the Company has a direct financial interest in a company with

which the Company has entered into a lease agreement for the Company's new corporate headquarters (see

Note 19).

An affiliate of one of the Sponsors participated as one of the joint book-running managers of our initial

public offering. This affiliate was paid $5 million pursuant to a customary underwriting agreement among the

Company and the several underwriters.

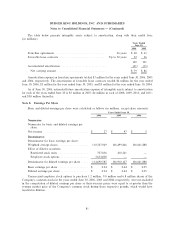

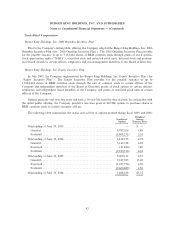

Note 15. Leases

At June 30, 2006, the Company leased 1,090 restaurant properties to franchisees and other non-

restaurant third parties under capital and operating leases. The building portions of the capital leases with

franchisees are accounted for as direct financing leases and recorded as a net investment in property leased to

franchisees, while the land and restaurant equipment components are recorded as operating leases and are

included in the table below.

Property and equipment, net leased to franchisees and other third parties under operating leases was as

follows (in millions):

Years Ended

June 30,

2006 2005

Land ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $196 $201

Buildings and improvementsÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 78 67

Restaurant equipment ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 2 2

276 270

Accumulated depreciationÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (23) (18)

Property and equipment, net leased to franchisees and other third parties under

operating leases ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $253 $252

89