Burger King 2006 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2006 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.BURGER KING HOLDINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements Ì (Continued)

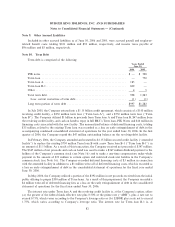

intangible assets and other liabilities, respectively. In connection with these adjustments to the preliminary

allocations, the Company recognized a net benefit of $2 million as a change in accounting estimate in the

fiscal year ended June 30, 2004. This net benefit consisted of $23 million in additional amortization related to

the adjustment to unfavorable leases and $1 million in other adjustments, partially offset by $18 million in

additional depreciation expense related to the adjustment to property and equipment and $4 million of

additional amortization expense related to the adjustment to favorable leases.

Initial Public Offering

In May 2006 the Company completed its initial public offering of 25,000,000 shares of common stock,

$0.01 par value, at a per share price of $17.00 with net proceeds after transaction costs to the Company of

approximately $392 million (the ""initial public offering''). The Sponsors sold an additional 3,750,000 shares,

to settle the underwriters' over-allotment option at $17.00 per share. After the consummation of the initial

public offering, the equity funds controlled by the Sponsors owned approximately 75.9% of the Company's

outstanding common stock. In connection with the initial public offering, the Board of Directors of the

Company authorized an increase in the number of shares of the Company's common stock to 300 million

shares, authorized a 26.34608 to one stock split, and authorized 10 million shares of a new class of preferred

stock, with a par value of $0.01 per share. As of June 30, 2006, no shares of this new class of preferred stock

were issued or outstanding. All references to the number of shares in these consolidated financial statements

and accompanying notes have been adjusted to reflect the stock split on a retroactive basis.

Note 2. Summary of Significant Accounting Policies

Basis of Presentation and Consolidation

The consolidated financial statements include the accounts of BKH and its majority-owned subsidiaries.

All material intercompany balances and transactions have been eliminated in consolidation. Investments in

affiliates where the Company owns between 20% and 50% are accounted for under the equity method, except

as discussed below.

In December 2003, the Financial Accounting Standards Board (""FASB'') issued Interpretation

No. 46R, Consolidation of Variable Interest Entities Ì an interpretation of ARB No. 51 (""FIN 46R'').

FIN 46R establishes guidance to identify variable interest entities (""VIE's''). FIN 46R requires VIE's to be

consolidated by the primary beneficiary who is exposed to the majority of the VIE's expected losses, expected

residual returns, or both. FIN 46R excludes from its scope operating businesses unless certain conditions exist.

A majority of franchise entities meet the definition of an operating business and, therefore, are exempt

from the scope of FIN 46R. Additionally, there are a number of franchise entities which do not meet the

definition of a business as a result of leasing arrangements and other forms of subordinated financial support

provided by the Company, including certain franchise entities that participated in the franchise financial

restructuring program (see Note 19) and, therefore, are considered variable interest entities. However, the

Company is not exposed to the majority of expected losses in any of these arrangements and, therefore, is not

the primary beneficiary required to consolidate any of these franchisees.

The Company has consolidated one joint venture created in fiscal 2005 that operates restaurants where

the Company is a 49% partner, but is deemed to be the primary beneficiary, as the joint venture agreement

provides protection to the joint venture partner from absorbing expected losses. The results of operations of

this joint venture are not material to the Company's results of operations and financial position.

72