Burger King 2006 Annual Report Download - page 51

Download and view the complete annual report

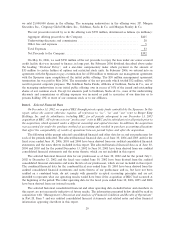

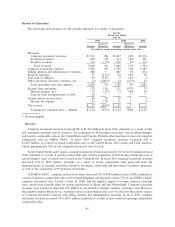

Please find page 51 of the 2006 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.As average restaurant sales increase, we can leverage payroll and employee benefits costs and occupancy

and other costs, resulting in a direct improvement in restaurant profitability. As a result, we believe our

continued focus on increasing average restaurant sales will result in improved profitability to our system-wide

restaurants.

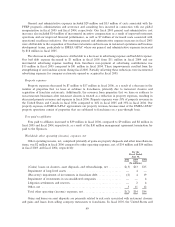

Our general and administrative expenses include the costs of field management for company and

franchise restaurants, costs of our operational excellence programs (including program staffing, training and

Clean & Safe certifications), and corporate overhead, including corporate salaries and facilities. We believe

that our current staffing and structure will allow us to expand our business globally without increasing general

and administrative expenses significantly. Our selling expenses are comprised of advertising and bad debt

expenses. Selling, general and administrative expenses also include amortization of intangible assets and

management fees paid to the Sponsors under our management agreement with them. We terminated this

management agreement in connection with our initial public offering. See ""Results of Operations Ì Fees Paid

to Affiliates''.

Property expenses include costs of depreciation and rent on properties we lease and sublease to

franchisees, respectively.

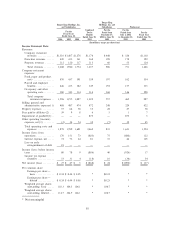

Fees paid to affiliates are comprised primarily of management fees paid to the Sponsors under a

management agreement that we entered into in connection with our acquisition of BKC. Under this

agreement, we paid a management fee to the Sponsors equal to 0.5% of our total current year revenues, which

amount was limited to 0.5% of the prior year's total revenues.

In February 2006, we entered into an agreement with the Sponsors to pay a termination fee of $30 million

to the Sponsors to terminate the management agreement upon completion of our initial public offering of

common stock. In May 2006, we paid the termination fee to the Sponsors.

Items classified as other operating (income) expenses, net include gains and losses on asset and business

disposals, impairment charges, settlement losses recorded in connection with acquisitions of franchise

operations, gains and losses on foreign currency transactions and other miscellaneous items.

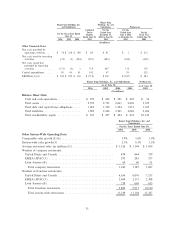

Advertising Funds

We promote our brand and products by advertising in all the countries and territories in which we

operate. In countries where we have company restaurants, such as the United States, Canada, the United

Kingdom and Germany, we manage an advertising fund for that country by collecting required advertising

contributions from company and franchise restaurants and purchasing advertising and other marketing

initiatives on behalf of all Burger King restaurants in that country. These advertising contributions are based on

a percentage of sales at company and franchise restaurants. We do not record advertising contributions

collected from franchisees as revenues or expenditures of these contributions as expenses. Amounts which are

contributed to the advertising funds by company restaurants are recorded as selling, general and administrative

expenses. In countries where we manage an advertising fund, we plan the marketing calendar in advance based

on expected contributions for that year into the fund. To the extent that contributions received exceed

advertising and promotional expenditures, the excess contributions are recorded as accrued advertising liability

on our consolidated balance sheets. If franchisees fail to make the expected contributions, we may not be able

to continue with our marketing plan for that year unless we make additional contributions into the fund. These

additional contributions are also recorded as selling, general and administrative expenses. We made additional

contributions of $1 million, $15 million and $41 million in fiscal 2006, fiscal 2005 and fiscal 2004, respectively.

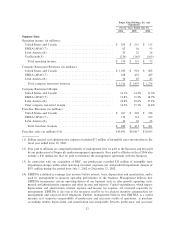

Key Business Measures

We track our results of operations and manage our business by using three key business measures on a

systemwide basis: comparable sales growth, average restaurant sales and system-wide sales growth. Compara-

ble sales growth and system-wide sales growth are analyzed on a constant currency basis, which means they

are calculated using prior year average exchange rates, to remove the effects of currency fluctuations from

these trend analyses. We believe these constant currency measures provide a more meaningful analysis of our

39