Burger King 2006 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2006 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

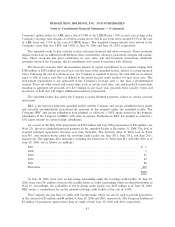

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements Ì (Continued)

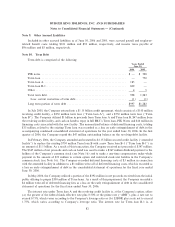

Note 9. Other Accrued Liabilities

Included in other accrued liabilities as of June 30, 2006 and 2005, were accrued payroll and employee-

related benefit costs totaling $101 million and $93 million, respectively, and income taxes payable of

$96 million and $5 million, respectively.

Note 10. Term Debt

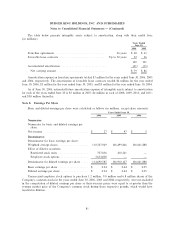

Term debt is comprised of the following:

Years Ended

June 30,

2006 2005

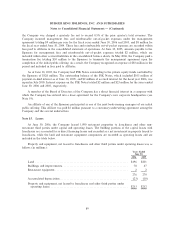

PIK notesÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ Ì $ 528

Term loan ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì 750

Term loan A ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 185 Ì

Term loan B-1ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 809 Ì

Other ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 4 5

Total term debt ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 998 1,283

Less: current maturities of term debt ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (1) (1)

Long term portion of term debt ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $997 $1,282

In July 2005, the Company entered into a $1.15 billion credit agreement, which consists of a $150 million

revolving credit facility, a $250 million term loan (""Term loan A''), and a $750 million term loan (""Term

loan B''). The Company utilized $1 billion in proceeds from Term loan A and Term loan B, $47 million from

the revolving credit facility, and cash on hand to repay in full BKC's Term loan, PIK Notes and $16 million in

financing costs associated with the new facility. The unamortized balance of deferred financing costs, totaling

$13 million, related to the existing Term loan was recorded as a loss on early extinguishment of debt in the

accompanying condensed consolidated statement of operations for the year ended June 30, 2006. In the first

quarter of 2006, the Company repaid the $47 million outstanding balance on the revolving debt facility.

In February 2006, the Company amended and restated its $1.15 billion secured credit facility (""amended

facility'') to replace the existing $750 million Term loan B with a new Term loan B-1 (""Term loan B-1'') in

an amount of $1.1 billion. As a result of this transaction, the Company received net proceeds of $347 million.

The $347 million of net proceeds and cash on hand was used to make a $367 million dividend payment to the

holders of the Company's common stock (see Note 16) and to make a one-time compensatory make-whole

payment in the amount of $33 million to certain option and restricted stock unit holders in the Company's

common stock (see Note 16). The Company recorded deferred financing costs of $3 million in connection

with the amended facility in addition to a $1 million write-off of deferred financing costs, which is recorded as

a loss on early extinguishment of debt in the consolidated statement of operations for the fiscal year ended

June 30, 2006.

In May 2006, the Company utilized a portion of the $392 million in net proceeds received from the initial

public offering to prepay $350 million of Term loans. As a result of this prepayment, the Company recorded a

$4 million write-off of deferred financing fees as a loss on the early extinguishment of debt in the consolidated

statement of operations for the fiscal year ended June 30, 2006.

The interest rate under Term loan A and the revolving credit facility is, at the Company's option, either

(a) the greater of the federal funds effective rate plus 0.50% or the prime rate (""ABR''), plus a rate not to

exceed 0.75%, which varies according to the Company's leverage ratio or (b) LIBOR plus a rate not to exceed

1.75%, which varies according to Company's leverage ratio. The interest rate for Term loan B-1 is, at

82