Burger King 2006 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2006 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

we sold 25,000,000 shares in the offering. The managing underwriters in the offering were J.P. Morgan

Securities Inc., Citigroup Global Markets Inc., Goldman, Sachs & Co. and Morgan Stanley & Co.

The net proceeds received by us in the offering were $392 million, determined as follows (in millions):

Aggregate offering proceeds to the CompanyÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $425

Underwriting discounts and commissions ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 28

Other fees and expenses ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 5

Total Expenses ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 33

Net Proceeds to the Company ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $392

On May 26, 2006, we used $350 million of the net proceeds to repay the loan under our senior secured

credit facility that was incurred to finance, in large part, the February 2006 dividend, described above under

the heading ""Dividend Policy'', and a one-time compensatory make whole payment in the amount of

$33 million to certain holders of options and restricted stock units. In February 2006, we entered into an

agreement with the Sponsors to pay a termination fee of $30 million to terminate our management agreement

with the Sponsors upon completion of the initial public offering. The $30 million management agreement

termination fee was paid in May 2006. The remainder of the net proceeds which totaled $12 million, will be

used for general corporate purposes. The Goldman Sachs Funds, affiliates of Goldman, Sachs & Co., one of

the managing underwriters in our initial public offering, own in excess of 10% of the issued and outstanding

shares of our common stock. Except for amounts paid to Goldman, Sachs & Co., none of the underwriting

discounts and commissions or offering expenses was incurred or paid to associates of our directors or to

persons holding 10% or more of our common stock or to our affiliates.

Item 6. Selected Financial Data

On December 13, 2002, we acquired BKC through private equity funds controlled by the Sponsors. In this

report, unless the context otherwise requires, all references to ""we'', ""us'' and ""our'' refer to Burger King

Holdings, Inc. and its subsidiaries, including BKC, for all periods subsequent to our December 13, 2002

acquisition of BKC. All references to our ""predecessor'' refer to BKC and its subsidiaries for all periods prior to

the acquisition, which operated under a different ownership and capital structure. In addition, the acquisition

was accounted for under the purchase method of accounting and resulted in purchase accounting allocations

that affect the comparability of results of operations between periods before and after the acquisition.

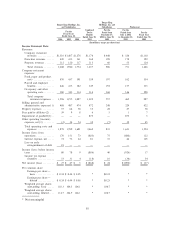

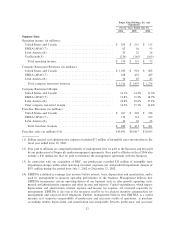

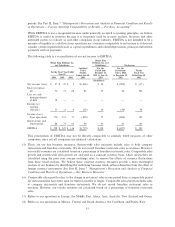

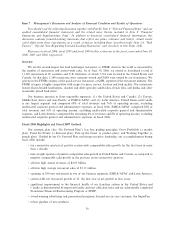

The following tables present selected consolidated financial and other data for us and our predecessor for

each of the periods indicated. The selected historical financial data as of June 30, 2006 and 2005 and for the

fiscal years ended June 30, 2006, 2005 and 2004 have been derived from our audited consolidated financial

statements and the notes thereto included in this report. The selected historical financial data as of June 30,

2004 and 2003 and for the period December 13, 2002 to June 30, 2003 have been derived from our audited

consolidated financial statements and the notes thereto, which are not included in this report.

The selected historical financial data for our predecessor as of June 30, 2002 and for the period July 1,

2002 to December 12, 2002 and the fiscal year ended June 30, 2002 have been derived from the audited

consolidated financial statements and notes thereto of our predecessor, which are not included in this report.

The combined financial data for the combined fiscal year ended June 30, 2003 have been derived from the

audited consolidated financial statements and notes thereto of our predecessor and us, but have not been

audited on a combined basis, do not comply with generally accepted accounting principles and are not

intended to represent what our operating results would have been if the acquisition of BKC had occurred at

the beginning of the period. The other operating data for the fiscal years ended June 30, 2006, 2005 and 2004

have been derived from our internal records.

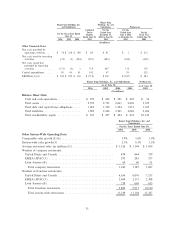

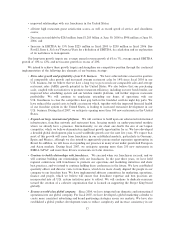

The selected historical consolidated financial and other operating data included below and elsewhere in

this report are not necessarily indicative of future results. The information presented below should be read in

conjunction with ""Management's Discussion and Analysis of Financial Condition and Results of Operations''

in Part II, Item 7 and our audited consolidated financial statements and related notes and other financial

information appearing elsewhere in this report.

29