Burger King 2006 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2006 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We believe the investments we made historically in the FFRP program will continue to provide a return

to us in the form of a reinvigorated franchise system in the United States and Canada.

Our Global Reorganization and Realignment

After our acquisition of BKC, we retained consultants during fiscal 2004 and fiscal 2005 to assist us in the

review of the management and efficiency of our business, focusing on our operations, marketing, supply chain

and corporate structure. In connection with these reviews, we reorganized our corporate structure to allow us

to operate as a global brand, including the elimination of certain corporate and international functions. Also in

connection with those reviews, we implemented operational initiatives which have helped us improve

restaurant operations. During fiscal 2006, we continued our global reorganization by regionalizing the activities

associated with our European and Asian businesses, including the transfer of rights of existing franchise

agreements, the ability to grant future franchise agreements and utilization of our intellectual property assets

in EMEA/APAC, in new European and Asian holding companies. See ""Liquidity and Capital Resources Ì

Realignment of our European and Asian businesses''.

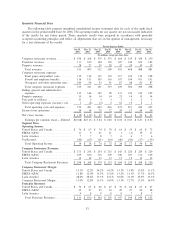

In connection with our global reorganization and related realignment of our European and Asian businesses,

we incurred costs of $10 million, $17 million and $22 million in fiscal 2006, fiscal 2005 and fiscal 2004,

respectively, consisting primarily of consulting and severance-related costs, which included severance payments,

outplacement services and relocation costs. The following table presents, for the periods indicated, such costs:

For the

Fiscal Year Ended

June 30,

2006 2005 2004

(In millions)

Consulting fees ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $10 $ 2 $14

Severance-related costs of the global reorganizationÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì 15 8

TotalÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $10 $17 $22

44