Burger King 2006 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2006 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

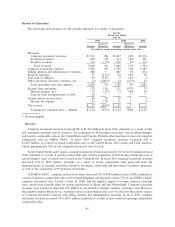

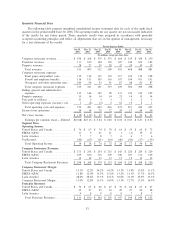

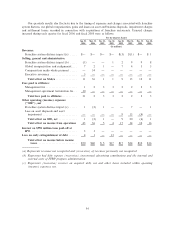

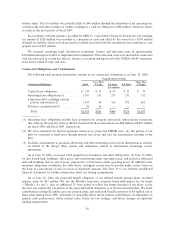

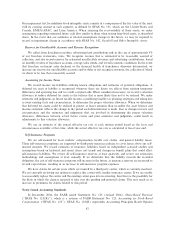

Comparable sales growth for each of the quarters in the fiscal years ended June 30, 2006 and 2005 was as

follows:

For the Quarters Ended

Jun 30, Mar 31, Dec 31, Sep 30, Jun 30, Mar 31, Dec 31, Sep 30,

2006 2006 2005 2005 2005 2005 2004 2004

(In constant currencies)

Comparable Sales Growth:

United States and CanadaÏÏÏÏÏÏÏ 2.0% 4.9% 2.3% 1.1% 1.2% 8.8% 9.1% 7.7%

EMEA/APAC ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 0.2% (0.4)% 1.3% (0.7)% 2.5% 2.8% 1.7% 4.1%

Latin AmericaÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 5.0% 1.5% 1.6% 1.5% 2.2% 5.6% 8.2% 6.4%

Total System-WideÏÏÏÏÏÏÏÏÏÏÏ 1.7% 3.3% 2.0% 0.7% 1.6% 7.1% 7.2% 6.8%

Liquidity and Capital Resources

Overview

Our cash flow from operations was $74 million in fiscal 2006 and was adversely affected by our payment

of the compensatory make-whole payment of $33 million, the management agreement termination fee of

$30 million and interest payment of $103 million related to the PIK Notes. As a result of the realignment of

our European and Asian businesses discussed below, we incurred $126 million in tax liability, which was

partially offset by $40 million through the utilization of net operating loss carryforwards and other foreign tax

credits resulting in a cash tax obligation of $86 million to be paid in the first quarter of fiscal 2007 associated

with this realignment.

We had cash and cash equivalents of $259 million at June 30, 2006. In addition, we currently have a

borrowing capacity of $109 million under our $150 million revolving credit facility (net of $41 million in letters

of credit issued under the revolving credit facility).

We expect that cash on hand, cash flow from operations and our borrowing capacity under our revolving

credit facility will allow us to meet cash requirements, including capital expenditures, tax payments, and debt

service payments, in the short-term and for the foreseeable future. If additional funds are needed for strategic

initiatives or other corporate purposes, we believe we could incur additional debt or raise funds through the

issuance of our securities.

July 2005 Refinancing, February 2006 Financing and Dividend and the Compensatory Make-Whole

Payment

On July 13, 2005, BKC entered into a $1.15 billion senior secured credit facility guaranteed by us, which

we refer to as the July 2005 refinancing and which consisted of a $150 million revolving credit facility, a

$250 million term loan, which we refer to as term loan A, and a $750 million term loan, which we refer to as

term loan B. We used $1 billion in proceeds from term loans A and B, $47 million of the revolving credit

facility, and cash on hand to repay in full the existing senior secured credit facility and payment-in-kind notes

payable to Diageo plc, the private equity funds controlled by the Sponsors and certain directors that we

incurred in connection with our acquisition of BKC and to pay $16 million in financing costs. In the first

quarter 2005, we repaid the $47 million outstanding balance on the revolver.

On February 15, 2006, we and BKC amended and restated the senior secured credit facility. We

borrowed $350 million under our senior secured credit facility, all the proceeds of which were used to pay,

along with $50 million of cash on hand, the February 2006 dividend, the compensatory make-whole payment

and financing costs and expenses. The amendments replaced the $746 million then outstanding under term

loan B with a new term loan B, which we refer to as term loan B-1, in an amount of $1.096 billion.

In May 2006, we utilized a portion of the $392 million in net proceeds we received from our initial public

offering to prepay $350 million of term debt, resulting in a debt balance of $994 million outstanding under the

term loan A and B-1 facilities. In July 2006, subsequent to the end fiscal 2006, we prepaid an additional

$50 million of term debt, reducing the term loan A and B-1 balance to $944 million. As a result of these

55