Burger King 2006 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2006 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.BURGER KING HOLDINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements Ì (Continued)

Company enters into an agreement with a franchisee that releases the franchisee from outstanding obligations,

(b) franchise agreements are terminated and the projected costs of collections exceed the benefits expected to

be received from pursuing the balance owed through legal action, or (c) franchisees do not have the financial

wherewithal or unprotected assets from which collection is reasonably assured.

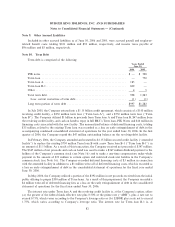

Notes receivable represent loans made to franchisees arising from re-franchisings of company owned

restaurants, sale of property, and in certain cases when past due trade receivables from franchisees are

generally restructured into an interest bearing note. Trade receivables which are restructured to interest

bearing notes are generally already fully reserved, and as a result, are transferred to notes receivables at a net

carrying value of zero. Notes receivable with a carrying value greater than zero are impaired when it is

probable or likely that the Company is unable to collect all amounts in accordance with the contractual terms

of the loan agreement, in accordance with SFAS No. 114, ""Accounting by Creditors for Impairment of a

Loan'' and SFAS No. 118, ""Accounting by Creditors for Impairment of a Loan Ì Income Recognition and

Disclosures.''

Inventories

Inventories, totaling $14 million and $15 million at June 30, 2006 and 2005, respectively, are stated at the

lower of cost (first-in, first-out) or net realizable value, and consist primarily of restaurant food items and

paper supplies. Inventories are included in prepaids and other current assets in the accompanying consolidated

balance sheets.

Property and Equipment, net

Property and equipment, net, owned by the Company are recorded at historical cost less accumulated

depreciation and amortization. Depreciation and amortization are computed using the straight-line method

based on the estimated useful lives of the assets. Leasehold improvements to properties where the Company is

the lessee are amortized over the lesser of the remaining term of the lease or the life of the improvement.

Improvements and major repairs with a useful life greater than one year are capitalized, while minor

maintenance and repairs are expensed when incurred.

Leases

The Company accounts for leases in accordance with SFAS No. 13, Accounting for Leases

(""SFAS No. 13''), and other related authoritative literature. Assets acquired under capital leases are stated at

the lower of the present value of future minimum lease payments or fair market value at the date of inception

of the lease. Capital lease assets are depreciated using the straight-line method over the shorter of the useful

life or the underlying lease term.

The Company records rent expense for operating leases that contain scheduled rent increases on a

straight-line basis over the lease term, including any renewal option periods considered in the determination of

that lease term. Contingent rentals are generally based on sales levels in excess of stipulated amounts, and thus

are not considered minimum lease payments.

The Company also enters into capital leases as lessor. Capital leases meeting the criteria of direct

financing leases under SFAS No. 13 are recorded on a net basis, consisting of the gross investment and

residual value in the lease less the unearned income. Unearned income is recognized over the lease term

yielding a constant periodic rate of return on the net investment in the lease. Direct financing leases are

reviewed for impairment whenever events or circumstances indicate that the carrying amount of an asset may

not be recoverable based on the payment history under the lease.

74