Burger King 2006 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2006 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.BURGER KING HOLDINGS, INC. AND SUBSIDIARIES

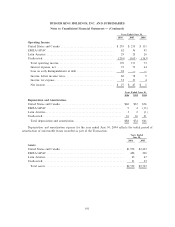

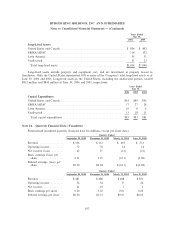

Notes to Consolidated Financial Statements Ì (Continued)

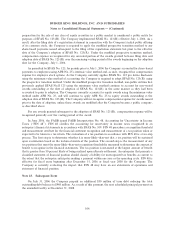

preparation for the sale of any class of equity securities in a public market is considered a public entity for

purposes of SFAS No. 123(R). The Company implemented SFAS No. 123(R) effective July 1, 2006. As a

result, after the filing date of a registration statement in connection with the Company's initial public offering

of its common stock, the Company is required to apply the modified prospective transition method to any

share-based payments issued subsequent to the filing of the registration statement but prior to the effective

date of the Company's adoption of SFAS No. 123(R). Under the modified prospective transition method,

compensation expense is recognized for any unvested portion of the awards granted between filing date and

adoption date of SFAS No. 123(R) over the remaining vesting period of the awards beginning on the adoption

date for the Company, July 1, 2006.

As permitted by SFAS No. 123, for periods prior to July 1, 2006 the Company accounted for share-based

payments to employees using APB No. 25's intrinsic value method and, as such, recognized no compensation

expense for employee stock options. As the Company currently applies SFAS No. 123 pro forma disclosure

using the minimum value method of accounting, the Company is required to adopt SFAS No. 123(R) using

the prospective transition method. Under the modified prospective transition method, non-public entities that

previously applied SFAS No.S 123 using the minimum value method continue to account for non-vested

awards outstanding at the date of adoption of SFAS No. 123(R) in the same manner as they had been

accounted to prior to adoption. The Company currently accounts for equity awards using the minimum value

method under APB No. 25, and will continue to apply APB No. 25 to equity awards outstanding at the

adoption date of SFAS No. 123(R). The Company will not recognize compensation expense for awards issued

prior to the date of adoption, unless those awards are modified after the Company became a public company,

as described above.

For any awards granted subsequent to the adoption of SFAS No. 123(R), compensation expense will be

recognized generally over the vesting period of the award.

In June 2006, the FASB issued FASB Interpretation No. 48, Accounting for Uncertainty in Income

Taxes (""FIN 48''). FIN 48 clarifies the accounting for uncertainty in income taxes recognized in an

enterprise's financial statements in accordance with SFAS No. 109. FIN 48 prescribes a recognition threshold

and measurement attribute for the financial statement recognition and measurement of a tax position taken or

expected to be taken in a tax return. The evaluation of a tax position in accordance with FIN 48 is a two-step

process. The first step is to determine whether it is more-likely-than-not that a tax position will be sustained

upon examination based on the technical merits of the position. The second step is the measurement of any

tax positions that meet the more-likely-than-not recognition threshold is measured to determine the amount of

benefit to recognize in the financial statements. The tax position is measured at the largest amount of benefit

that is greater than 50 percent likely of being realized upon ultimate settlement. An enterprise that presents a

classified statement of financial position should classify a liability for unrecognized tax benefits as current to

the extent that the enterprise anticipates making a payment within one year or the operating cycle. FIN 48 is

effective for fiscal years beginning after December 15, 2006 or fiscal year 2008 for the Company. The

Company is currently evaluating the impact that FIN 48 may have on our statements of operations and

statement of financial position.

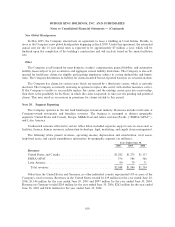

Note 23. Subsequent Event

On July 31, 2006 the Company prepaid an additional $50 million of term debt reducing the total

outstanding debt balance to $948 million. As a result of this payment, the next scheduled principal payment on

the amended facility is December 31, 2008.

104