Audi 2010 Annual Report Download - page 235

Download and view the complete annual report

Please find page 235 of the 2010 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

233

Consolidated Financial

Statements

184 Income Statement

185 Statement of Recognized

Income and Expense

186 Balance Sheet

187 Cash Flow Statement

188 Statement of Changes in Equity

Notes to the Consolidated

Financial Statements

190 Development of fixed assets

in the 2010 fiscal year

192 Development of fixed assets

in the 2009 fiscal year

194 General information

200 Recognition and

measurement principles

207 Notes to the Income Statement

214 Notes to the Balance Sheet

223 Additional disclosures

242 Events occurring subsequent

to the balance sheet date

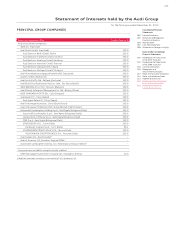

243 Statement of Interests

held by the Audi Group

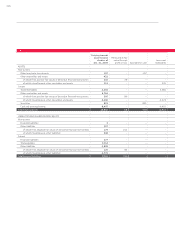

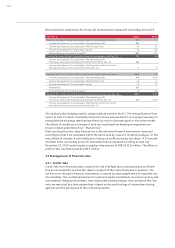

Hedging measures relate principally to significant quantities of the commodities aluminum and

copper. Contracts are concluded exclusively with first-rate national and international banks

whose creditworthiness is regularly examined by leading rating agencies.

Commodity price risks are also calculated using sensitivity analyses. Hypothetical changes in

listed prices are used to quantify the impact of changes in value of the hedging transactions on

equity and on profit before tax.

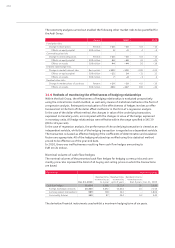

Interest rate risks

Interest rate risks stem from changes in market rates, above all for medium and long-term

variable-rate assets and liabilities.

The Audi Group limits interest rate risks, particularly with regard to the granting of loans and

credit, by agreeing fixed interest rates and also through interest rate swaps.

The risks associated with changing interest rates are presented in accordance with IFRS 7 using

sensitivity analyses. These involve presenting the effects of hypothetical changes in market

interest rates at the balance sheet date on interest payments, interest income and expenses,

and, where applicable, equity.

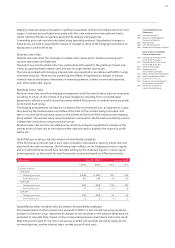

Residual value risks

Residual value risks arise from hedging arrangements with the retail trade or partner companies

according to which, in the context of buy-back obligations resulting from concluded lease

agreements, effects on profit caused by market-related fluctuations in residual values are partly

borne by the Audi Group.

The hedging arrangements are based on residual value recommendations, as adopted on a quar-

terly basis by the residual value committee at the time of the contract being concluded, and

then on current dealer purchase values on the market at the time of the residual value hedging

being settled. The residual value recommendations are based on the forecasts provided by various

independent institutions using transaction prices.

Residual value risks are also calculated using sensitivity analyses. Hypothetical changes in the

market prices of used cars at the balance sheet date are used to quantify the impact on profit

before tax.

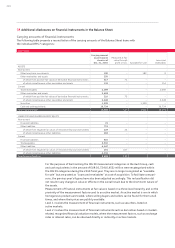

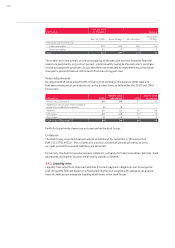

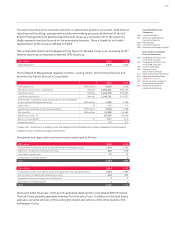

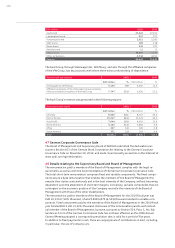

Quantifying currency risks by means of sensitivity analyses

If the functional currencies had in each case increased or decreased in value by 10 percent com-

pared with the other currencies, the following major effects on the hedging provision in equity

and on profit before tax would have resulted. Adding up the individual figures is not an appro-

priate approach, as the results for each functional currency are based on differing scenarios.

EUR million Dec. 31, 2010 Dec. 31, 2009

+ 10 % – 10 %+ 10 % – 10 %

Currency relation

EUR/USD

Hedging provision 1,249 – 1,181 487 – 365

Profit before tax 20 – 49 – 24 – 40

EUR/GBP

Hedging provision 325 – 325 184 – 182

Profit before tax 0 – 0– 38

EUR/JPY

Hedging provision 126 – 126 49 – 49

Profit before tax – 1 1 – 22

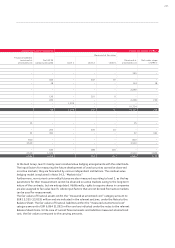

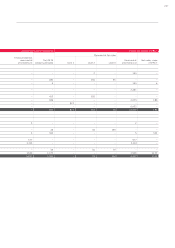

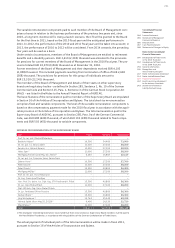

Quantifying other market risks by means of sensitivity analyses

The measurement of other market risks pursuant to IFRS 7 is also carried out using sensitivity

analyses in the Audi Group. Hypothetical changes to risk variables on the balance sheet date are

examined to calculate their impact on the corresponding balance sheet items and on the result.

Depending on the type of risk, there are various possible risk variables (primarily equity prices,

commodity prices, market interest rates, market prices of used cars).