Audi 2010 Annual Report Download - page 219

Download and view the complete annual report

Please find page 219 of the 2010 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

217

Consolidated Financial

Statements

184 Income Statement

185 Statement of Recognized

Income and Expense

186 Balance Sheet

187 Cash Flow Statement

188 Statement of Changes in Equity

Notes to the Consolidated

Financial Statements

190 Development of fixed assets

in the 2010 fiscal year

192 Development of fixed assets

in the 2009 fiscal year

194 General information

200 Recognition and

measurement principles

207 Notes to the Income Statement

214 Notes to the Balance Sheet

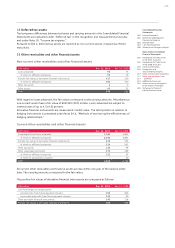

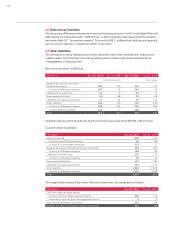

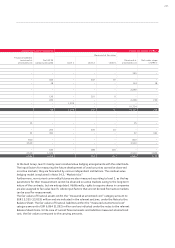

217 Liabilities

223 Additional disclosures

242 Events occurring subsequent

to the balance sheet date

243 Statement of Interests

held by the Audi Group

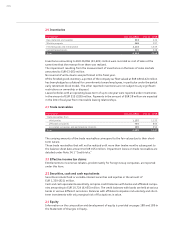

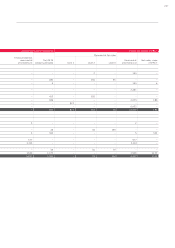

The share capital of AUDI AG is EUR 110,080,000. One share grants an arithmetical share of

EUR 2.56 of the issued capital. This capital is divided into 43,000,000 no-par bearer shares.

The capital reserves contain premiums paid in connection with the issuance of shares of the

Company. In the year under review, capital reserves rose to EUR 2,510 million as a result of a

contribution in the amount of EUR 586 million by Volkswagen AG, Wolfsburg, to the capital

reserve of AUDI AG.

The opportunities and risks under foreign exchange, currency option, commodity price and in-

terest hedging transactions serving as hedges for future cash flows are deferred in the reserve

for cash flow hedges with no effect on income. When the cash flow hedges become due, the

results from the settlement of the hedging contracts are reported under the operating profit.

Unrealized gains and losses from the measurement at fair value of securities available for sale

are recognized in the reserve for the market-price measurement of securities. Upon disposal of

the securities, share price gains and losses realized are reported under the financial result.

Adjustments to actuarial assumptions on retirement benefit obligations, with no effect on

income, are recognized in the provisions for actuarial gains and losses.

Pursuant to IAS 28.39, foreign currency translation differences that do not affect income from

the accounting of FAW-Volkswagen Automotive Company, Ltd., Changchun (China), using the

equity method are included in the reserve for investments accounted for using the equity method.

With effect from June 1, 2010, the Group acquired 100 percent of the shares in AUDI BRUSSELS

S.A./N.V., Brussels (Belgium), for a purchase price of EUR 125 million. The equity of AUDI

BRUSSELS S.A./N.V. remaining after deduction of the purchase price was reclassified from minority

interests to AUDI AG stockholders’ interests.

The shares held by minority interests in the equity capital can be broken down as follows, with

each shareholder holding 100 percent of the shares in the listed companies and to whom the

result achieved by the company is attributable:

Fully consolidated group company Minority interests

Audi Canada Inc., Ajax (Canada) Volkswagen Group Canada, Inc., Ajax (Canada)

Audi of America, LLC, Herndon (USA) VOLKSWAGEN GROUP OF AMERICA, INC., Herndon (USA)

Automobili Lamborghini America, LLC,

Wilmington, Delaware (USA) VOLKSWAGEN GROUP OF AMERICA, INC., Herndon (USA)

The balance of EUR 576 (128) million remaining after the transfer of profit to Volkswagen AG is

allocated to the other retained earnings.

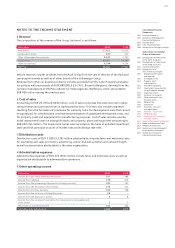

LIABILITIES

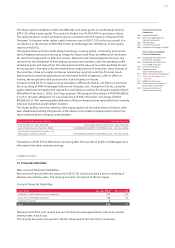

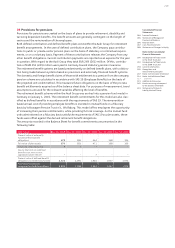

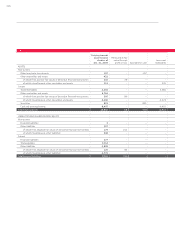

25 Financial liabilities

Non-current financial liabilities

Non-current financial liabilities amount to EUR 15 (2) million and have a time to maturity of

between one and five years. The carrying amounts correspond to the fair values.

Current financial liabilities

EUR million Dec. 31, 2010 Dec. 31, 2009

Liabilities to affiliated factoring companies 714 514

Loans from affiliated companies 88 62

Liabilities to banks 8–

Total 810 577

Measurement of the non-current and current financial lease agreements is based on market

interest rates in each case.

The carrying amounts correspond to the fair values due to the short-term maturities.