Audi 2010 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2010 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

142

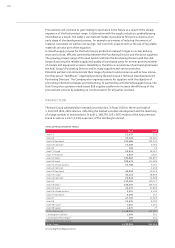

Registrations of new cars in Western Europe (excluding Germany) edged up only slightly by 1.9

percent in the year under review, to 10.1 (9.9) million. Market growth was still high especially in

the first half of the year thanks to government incentives; registrations of new cars then fell in

the latter part of the year along with the expiry of these subsidy programs. Of Western Europe’s

major car markets, Spain and the UK posted slight growth of 3.0 and 1.8 percent respectively in

2010, after contracting sharply in the previous year. On the other hand, the car market in Italy

shed all of 9.2 percent. The French car market, too, shrank by 2.6 percent.

Demand for autos remained weak in most countries of Central and Eastern Europe in 2010. The

exception was the Russian car market, which grew by 29.0 percent to 1.8 (1.4) million passen-

ger cars thanks to state subsidies for those purchasing locally built vehicles.

The economic recovery in the United States also helped to stimulate the car market. In a turn-

around from the sharp slump in sales in preceding years, vehicle sales rose once more in 2010,

growing by 11.1 percent to 11.6 (10.4) million passenger cars and light commercial vehicles.

In Latin America the Brazilian car market achieved a new record of 2.6 (2.5) million vehicles

sold, with growth of 6.9 percent. The car market in Argentina, too, gained 27.6 percent to reach

a record level of 0.5 (0.4) million passenger cars.

In the Asia-Pacific region the pace of growth increased still further in 2010 compared with its

already dynamic performance in the previous year. The sales volume there grew by 24.0 percent

to 22.1 (17.8) million passenger cars in total. This development was principally driven by the

Chinese car market, which – supported by state incentives – grew by 35.1 percent to 11.5 (8.5)

million cars. The car market in India enjoyed similarly high expansion, increasing by 29.8 percent

to 2.2 (1.7) million passenger cars. Tax breaks and an environment bonus in Japan fueled market

growth of 7.4 percent to 4.2 (3.9) million new car registrations.

German car market

The German car market suffered a sharp drop of 23.4 percent in 2010 compared with the previous

year, when growth had been exceptionally high thanks to the availability of the environment

bonus. Registrations of new cars slipped to 2.9 million, the lowest level since German reunifica-

tion. The manufacturers of small cars and vehicles in the compact category, which had been the

main beneficiaries of the environment bonus for private customers in 2009, bore the brunt

of this downturn in sales volume in the year under review. By contrast the premium segment

remained largely stable, with the result that the suppliers of premium vehicles saw their market

shares recover.

The diesel share of total first-time registrations in 2010 rose year on year by 11.2 percentage

points to 41.9 percent and thus approached the long-term level again. In 2009 the sharp rise in

car purchases by private customers, who mainly wanted gasoline models, temporarily led to a

drop in this diesel share.

Along with the worldwide recovery in demand for cars, the export situation of German car manu-

facturers improved substantially compared with the weak previous year. German car exports in

2010 climbed to 4.2 million units – a growth rate of 23.7 percent. As in previous years, Western

European countries remained the most important sales region for German car manufacturers, to

which they exported a total of 2.2 million passenger cars (+ 7.5 percent). Exports to the United

States also performed highly positively, rising by 44.4 percent to 0.5 million vehicles. The

mainstay of German export growth was the Chinese car market.

Strong export demand prompted a rise in domestic production by German car manufacturers

during the period under review. The production volume of 5.6 million passenger cars bettered

the prior-year figure by 11.8 percent and thus neared the pre-crisis level achieved in 2007. The

number of German-brand cars built abroad also increased year on year by 25.4 percent to 6.1

million units.