Audi 2010 Annual Report Download - page 204

Download and view the complete annual report

Please find page 204 of the 2010 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263

|

|

202

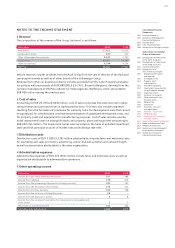

INVESTMENTS ACCOUNTED FOR USING THE EQUITY METHOD

Companies in which AUDI AG is directly or indirectly able to exercise significant influence on

financial and operating policy decisions (associated companies) are accounted for using the

equity method. The pro rata equity of these companies is regularly recorded under long-term

investments and the share of earnings recorded as income under the financial result.

IMPAIRMENT TESTS

Fixed assets are tested regularly for impairment as of the balance sheet date. Impairment testing

of goodwill and intangible assets with a non-determined useful life is generally carried out in

the Audi Group on the basis of the useful value of the Group’s automotive business as a cash

flow-generating unit. The current planning prepared by management provides the basis for this

process. As a general rule the planning period covers a period of five years. Plausible assump-

tions about future development are made for the subsequent years. The planning premises are

in each case adjusted in line with current findings. Appropriate assumptions based on macro-

economic trends and historical developments are taken into account. Cash flows are generally

calculated on the basis of the expected growth rates in the automotive markets concerned.

When calculating useful value as part of goodwill impairment testing, a country-specific dis-

counting rate of 5.5 percent before taxes is applied.

Impairment tests are carried out for development activities, acquired property rights, and prop-

erty, plant and equipment on the basis of expected product life cycles, the respective revenue

and cost situation, current market expectations and currency-specific factors. Expected future

cash flows to other intangible assets and fixed tangible assets are discounted with country-

specific discount rates that adequately reflect the risk and amount to 6.4 percent before tax.

Impairment losses pursuant to IAS 36 are recognized where the recoverable amount, i.e. the

higher amount from either the use or disposal of the asset in question, has declined below its

carrying amount. If necessary, an impairment loss resulting from this test is recognized.

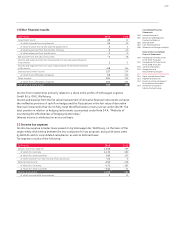

FINANCIAL INSTRUMENTS

Financial assets and liabilities (financial instruments) are recognized and measured in accordance

with IAS 39.

Pursuant to IAS 39, financial assets are divided into the following categories based on the purpose

for which they were acquired:

– financial assets measured at fair value through profit or loss,

– loans and receivables,

– held-to-maturity investments,

– available-for-sale financial assets.

The Audi Group does not have any financial assets that fall into the category of “held-to-maturity

investments.”

Financial liabilities are classed as follows depending on the reasons for their acquisition:

– financial liabilities measured at fair value through profit or loss,

– financial liabilities measured at amortized cost.

Assignment to a category depends on the purpose for which the financial instruments were

acquired and is reviewed at the end of each reporting period.