Audi 2010 Annual Report Download - page 208

Download and view the complete annual report

Please find page 208 of the 2010 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

206

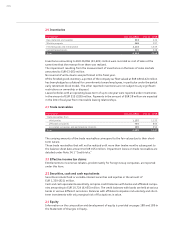

PROVISIONS FOR PENSIONS

Actuarial measurement of provisions for pensions is based on the projected unit credit method

for defined retirement benefit plans as specified in IAS 19 (Employee Benefits). This method

takes account of pensions and entitlements to future pensions known at the balance sheet date

as well as anticipated future pay and pension increases.

Actuarial gains and losses are reported in a separate line item within equity, with no effect on

income, after taking deferred tax into account.

OTHER PROVISIONS

In accordance with IAS 37, provisions are recognized if an obligation existing toward third

parties is likely to lead to cash outflows and where the amount of the obligation can reliably

be estimated.

Pursuant to IAS 37, the other provisions for all discernible risks and uncertain liabilities are

reported at their probable cost and are not offset against recourse entitlements.

Provisions with over one year to maturity are measured at their discounted settlement value as

of the balance sheet date. Market rates are used as the discount rates. Since the settlement

value pursuant to IAS 37 also includes the cost increases to be taken into account on the balance

sheet date, a nominal interest rate of 2.1 percent was applied in Germany.

MANAGEMENT’S ESTIMATES AND ASSESSMENTS

To some degree, the preparation of the Consolidated Financial Statements entails assumptions

and estimates with regard to the level and disclosure of the recognized assets and liabilities,

income and expenditure, and contingent liabilities for the reporting period.

The assumptions and estimates relate principally to the reporting of intangible assets, the

Group-wide determination of the useful life of property, plant and equipment and investment

property, any impairment of fixed assets and inventories, the collectability of receivables, and

the recognition and measurement of provisions.

The assumptions and estimates are based on premises that reflect the facts as known at any

given time. In particular, the circumstances at the time of preparation of the Consolidated

Financial Statements as well as the realistically assumed future development of the global and

industry-specific environment are used as a basis for estimating expected future business devel-

opment. Developments in this environment that deviate from assumptions and are beyond the

management’s sphere of influence may cause the actual amounts to differ from the estimates

originally anticipated. If the actual development varies from the anticipated development, the

premises and, if necessary, the carrying amounts for the assets and liabilities in question are

adjusted accordingly.

At the time of preparation of the Consolidated Financial Statements, the underlying assump-

tions and estimates were not exposed to any material risks. At present, the management does

not therefore believe that there will be a requirement in the following fiscal year for any materi-

al adjustment to the carrying amounts of assets and liabilities reported in the Consolidated

Balance Sheet.

Estimates and assumptions by the management were based on assumptions that are explained

in the report on expected developments in the Management Report.