Audi 2010 Annual Report Download - page 203

Download and view the complete annual report

Please find page 203 of the 2010 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

201

Consolidated Financial

Statements

184 Income Statement

185 Statement of Recognized

Income and Expense

186 Balance Sheet

187 Cash Flow Statement

188 Statement of Changes in Equity

Notes to the Consolidated

Financial Statements

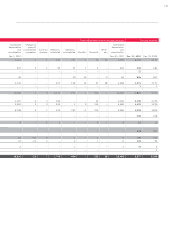

190 Development of fixed assets

in the 2010 fiscal year

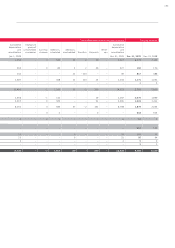

192 Development of fixed assets

in the 2009 fiscal year

194 General information

200 Recognition and

measurement principles

200 Recognition of income

and expenses

200 Intangible assets

201 Property, plant

and equipment

201 Investment property

202 Investments accounted for

using the equity method

202 Impairment tests

202 Financial instruments

204 Other receivables and

financial assets

205 Deferred tax

205 Inventories

205 Securities, cash and

cash equivalents

206 Provisions for pensions

206 Other provisions

206 Management’s estimates

and assessments

207 Notes to the Income Statement

214 Notes to the Balance Sheet

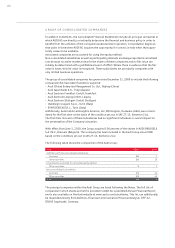

223 Additional disclosures

242 Events occurring subsequent

to the balance sheet date

243 Statement of Interests

held by the Audi Group

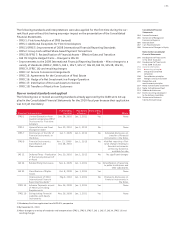

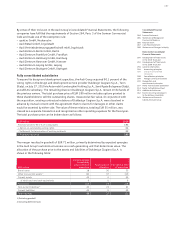

PROPERTY, PLANT AND EQUIPMENT

Property, plant and equipment are measured at acquisition cost or cost of construction, with

scheduled straight-line depreciation applied pro rata temporis.

The costs of purchase include the purchase price, ancillary costs and cost reductions.

In the case of self-constructed fixed assets, the cost of construction includes both the directly

attributable cost of materials and cost of labor as well as indirect materials and indirect labor,

which must be capitalized, together with pro rata depreciation. No interest was capitalized in

relation to borrowing costs due to the fact that there were no significant borrowings as defined

in the criteria of IAS 23 given that the Audi Group maintains sufficient levels of net liquidity

at all times. The depreciation plan is generally based on the following useful lives, which are

reassessed yearly:

Useful life

Buildings 14–50 years

Land improvements 10–33 years

Plant and machinery 6–12 years

Plant and office equipment including special tools 3–15 years

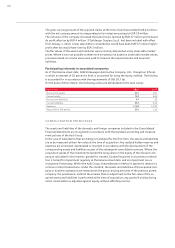

In accordance with IAS 17, property, plant and equipment used on the basis of lease agreements

is capitalized in the Balance Sheet if the conditions of a finance lease are met (in other words, if

the significant risks and opportunities which result from its use have passed to the lessee). Capi-

talization is performed at the time of the agreement, at the lower of fair value or present value

of the minimum lease payments. The straight-line depreciation method is based on the shorter

of economic life or term of lease contract. The payment obligations resulting from the future

lease installments are recognized as a liability at the present value of the leasing installments.

Where Group companies have entered into operating leases as the lessee, in other words if not

all risks and opportunities associated with title have passed to them, leasing installments and

rents are expensed directly in the Income Statement.

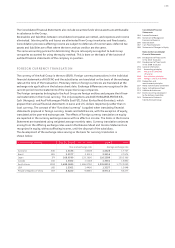

INVESTMENT PROPERTY

Investment property comprises real estate held as a financial investment and vehicles leased as

part of operating lease agreements with a contractual term of more than one year.

Real estate held as investment property is reported in the Balance Sheet at amortized cost.

Buildings are depreciated on a straight-line basis over a useful life of 33 years.

Leased vehicles, in the case of operating lease agreements, are capitalized at cost of sales and

depreciated to the calculated residual value on a straight-line basis over the contractual term.

Unscheduled reductions for impairment and adjustments to depreciation rates are made to take

account of impairment losses calculated on the basis of impairment testing pursuant to IAS 36.

Based on local factors and historical values from used car marketing, updated internal and ex-

ternal information on residual value developments is incorporated into the residual value fore-

casts on an ongoing basis.