Audi 2010 Annual Report Download - page 207

Download and view the complete annual report

Please find page 207 of the 2010 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

205

Consolidated Financial

Statements

184 Income Statement

185 Statement of Recognized

Income and Expense

186 Balance Sheet

187 Cash Flow Statement

188 Statement of Changes in Equity

Notes to the Consolidated

Financial Statements

190 Development of fixed assets

in the 2010 fiscal year

192 Development of fixed assets

in the 2009 fiscal year

194 General information

200 Recognition and

measurement principles

200 Recognition of income

and expenses

200 Intangible assets

201 Property, plant

and equipment

201 Investment property

202 Investments accounted for

using the equity method

202 Impairment tests

202 Financial instruments

204 Other receivables and

financial assets

205 Deferred tax

205 Inventories

205 Securities, cash and

cash equivalents

206 Provisions for pensions

206 Other provisions

206 Management’s estimates

and assessments

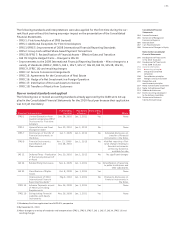

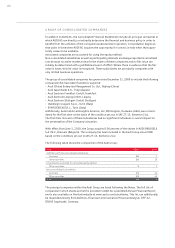

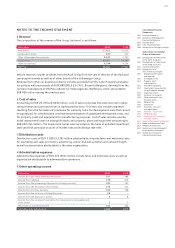

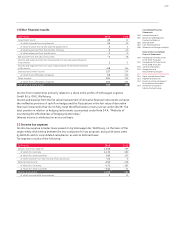

207 Notes to the Income Statement

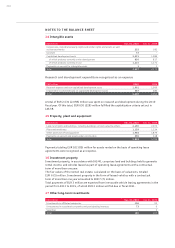

214 Notes to the Balance Sheet

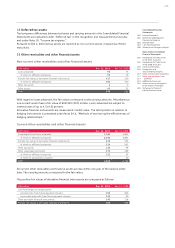

223 Additional disclosures

242 Events occurring subsequent

to the balance sheet date

243 Statement of Interests

held by the Audi Group

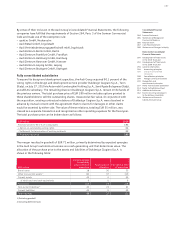

DEFERRED TAX

Pursuant to IAS 12, deferred tax is determined according to the balance sheet-focused liability

method. This method specifies that tax deferrals are to be created for all temporary differences

between the tax base of assets and liabilities and their carrying amounts in the Consolidated

Balance Sheet (temporary concept). Deferred tax assets relating to carryforward of unused tax

losses must also be recognized.

Deferrals amounting to the anticipated tax burden or tax relief in subsequent fiscal years are

created on the basis of the anticipated tax rate at the time of realization. In accordance with

IAS 12, the tax consequences of distributions of profit are not recognized until the resolution on

the appropriation of profits is adopted.

Deferred tax assets include future tax relief resulting from temporary differences between the

carrying amounts in the Consolidated Balance Sheet and the valuations in the Balance Sheet

for tax purposes. Deferred tax assets relating to carryforward of unused tax losses that can be

realized in the future and deferred tax assets from tax relief are also recognized.

Deferred tax assets and deferred tax liabilities are netted if the tax creditors and maturities are

identical.

Pursuant to IAS 1.70, deferred tax is reported as non-current.

The carrying amount is reduced for deferred tax assets that are unlikely to be realized.

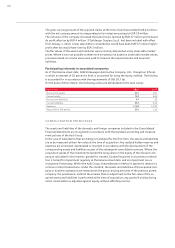

INVENTORIES

Raw materials and supplies are measured at the lower of average cost of acquisition or net re-

alizable value. Generally, an average value or a value calculated on the basis of the FIFO (first in,

first out) process is used. Other costs of purchase and purchase cost reductions are taken into

account as appropriate.

Work in progress and finished goods are valued at the lower of cost of conversion or net realizable

value. Cost of conversion includes direct materials and direct productive wages, as well as a

directly attributable portion of the necessary indirect materials and indirect labor costs, scheduled

production-related depreciation, and expenses attributable to the products from the scheduled

amortization of capitalized production development costs. Distribution costs, general adminis-

trative expenses and interest on borrowings are not capitalized.

Merchandise is valued at the lower of cost of purchase or net realizable value.

Provision has been made for all discernible storage and inventory risks in the form of appropriate

reductions in the carrying amounts. Individual adjustments are made on all inventories as soon

as the probable proceeds realizable from their sale or use are lower than the carrying amounts

of the inventories. The net realizable value is deemed to be the estimated proceeds of sale less

the estimated costs incurred up until the sale.

Current leased assets comprise leased vehicles with an operating lease of up to one year and

vehicles which are subject to a buy-back obligation within one year (owing to buy-back agree-

ments). These vehicles are capitalized at cost of sales and valued in accordance with the expected

loss of value and likely useful life. Based on local factors and historical values from used car

marketing, updated internal and external information is incorporated into the measurement on

an ongoing basis.

SECURITIES, CASH AND CASH EQUIVALENTS

Securities held as current assets are measured at market value, i.e. at the trading price on the

balance sheet date.

Cash and cash equivalents are stated at their nominal value.