Audi 2010 Annual Report Download - page 234

Download and view the complete annual report

Please find page 234 of the 2010 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

232

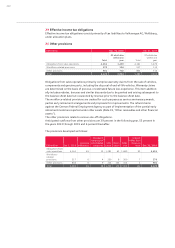

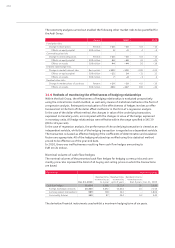

Marketable derivative financial instruments (foreign exchange contracts, currency option trans-

actions and currency swaps) are used for this purpose. Contracts are concluded exclusively with

first-rate national and international banks whose creditworthiness is regularly examined by

leading rating agencies.

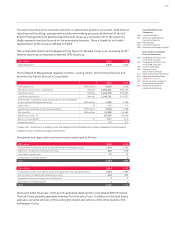

For the purpose of managing currency risks, exchange rate hedging in the 2010 fiscal year focused

on the U.S. dollar, the pound sterling and the Japanese yen.

Currency risks pursuant to IFRS 7 arise as a result of financial instruments that are denominated

in a currency other than the functional currency and are of a monetary nature. Exchange rate

variances from the translation of financial statements into the Group currency (translation risk)

are disregarded. Within the Audi Group, the principal non-derivative monetary financial instru-

ments (liquid assets, receivables, securities held and equity instruments held, interest-bearing

liabilities, interest-free liabilities) are either denominated directly in the functional currency or

substantially transferred to the functional currency through the use of derivatives. Above all, the

generally short maturity of the instruments also means that potential exchange rate movements

have only a very minor impact on profit or equity.

Currency risks are measured using sensitivity analyses, during which the impact on profit and

equity of hypothetical changes to relevant risk variables is assessed. All non-functional curren-

cies in which the Audi Group enters into financial instruments are fundamentally treated as

relevant risk variables.

The periodic effects are determined by applying the hypothetical changes in the risk variables

to the inventory of financial instruments on the reporting date. It is assumed for this purpose

that the inventory on the reporting date is representative of the entire year. Movements in the

exchange rate against the underlying currencies for the hedged transactions affect the cash flow

hedge reserve in equity and the fair value of these hedging transactions.

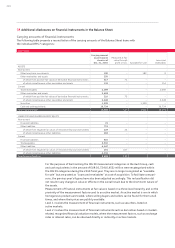

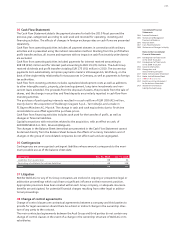

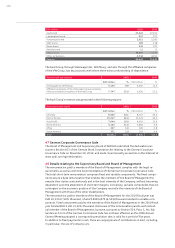

Fund price risks

The securities funds created using surplus liquidity are exposed, in particular, to an equity and

bond price risk that may arise from fluctuations in stock market prices and indices, and market

interest rates. The changes in bond prices resulting from a variation in market interest rates, like

the measurement of currency and other interest rate risks arising from the securities funds, are

quantified separately in the corresponding notes on “Currency risks” and “Interest rate risks.”

Risks from securities funds are generally countered by maintaining a broad mix of products,

issuers and regional markets when investing funds, as stipulated in the investment guidelines.

Where necessitated by the market situation, currency hedges in the form of futures contracts

are also used. Such measures are coordinated by AUDI AG in agreement with the Group Treasury

of Volkswagen AG, Wolfsburg, and implemented at operational level by the securities funds’ risk

management teams.

Fund price risks are measured within the Audi Group in accordance with IFRS 7 using sensitivity

analyses. Hypothetical changes to risk variables on the balance sheet date are examined to cal-

culate their impact on the prices of the financial instruments in the funds. Market prices and

indices are particularly relevant risk variables in the case of fund price risks.

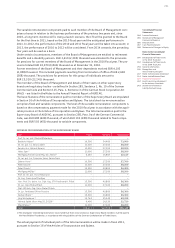

Commodity price risks

Commodities are subject to the risk of fluctuating prices given the volatile nature of the com-

modity markets. Commodity futures are used to limit these risks. The hedging measures are

coordinated regularly between AUDI AG and Volkswagen AG, Wolfsburg, in accordance with the

existing Volkswagen organizational guideline. The hedging transactions are performed centrally

for AUDI AG by Volkswagen AG on the basis of an agency agreement. The results from hedging

contracts are credited or debited to the Audi Group on the basis of the proportionate share of

the Volkswagen Group’s overall hedging volume.