Audi 2010 Annual Report Download - page 205

Download and view the complete annual report

Please find page 205 of the 2010 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

203

Consolidated Financial

Statements

184 Income Statement

185 Statement of Recognized

Income and Expense

186 Balance Sheet

187 Cash Flow Statement

188 Statement of Changes in Equity

Notes to the Consolidated

Financial Statements

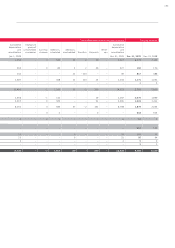

190 Development of fixed assets

in the 2010 fiscal year

192 Development of fixed assets

in the 2009 fiscal year

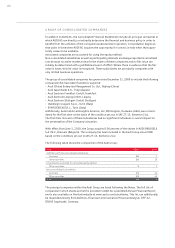

194 General information

200 Recognition and

measurement principles

200 Recognition of income

and expenses

200 Intangible assets

201 Property, plant

and equipment

201 Investment property

202 Investments accounted for

using the equity method

202 Impairment tests

202 Financial instruments

204 Other receivables and

financial assets

205 Deferred tax

205 Inventories

205 Securities, cash and

cash equivalents

206 Provisions for pensions

206 Other provisions

206 Management’s estimates

and assessments

207 Notes to the Income Statement

214 Notes to the Balance Sheet

223 Additional disclosures

242 Events occurring subsequent

to the balance sheet date

243 Statement of Interests

held by the Audi Group

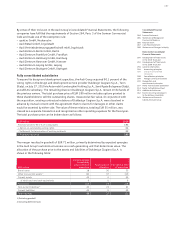

Where financial instruments are purchased or sold in the customary manner, they are recog-

nized using settlement date accounting (in other words, at the value on the day on which the

asset is delivered).

Initial measurement of financial assets and liabilities is carried out at fair value.

Subsequent measurement of financial instruments is dependent on the category assigned to

the instrument in accordance with IAS 39 and is carried out either at amortized cost (using the

effective interest method) or at fair value.

The amortized cost of a financial asset or financial liability, using the effective interest method,

is the amount at which a financial instrument was measured at initial recognition minus any

principal repayments, impairment losses or uncollectible debts.

In the case of current financial assets and liabilities, the amortized cost basically corresponds to

the nominal value or the repayment value. Fair value generally corresponds to the market value

or trading price. If no active market exists, fair value is determined using investment mathemat-

ics methods, for example by discounting future cash flows at the market rate or applying estab-

lished option pricing models.

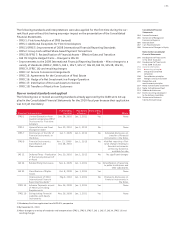

Measurement of financial instruments at fair value is based on a three-level hierarchy which

describes the proximity of the measurement factors used to an active market (cf. Note 33,

“Additional disclosures on financial instruments in the Balance Sheet”).

Recognizable credit risks associated with “Loans and receivables” are accounted for by carrying

out specific value adjustments. “Available-for-sale financial assets” are impaired if there is ob-

jective evidence of a long-term loss of value.

Financial instruments are abandoned if the rights to payments from the investment have expired

or been transferred and the Audi Group has substantially transferred all risks and opportunities

associated with their title.

Financial assets and liabilities include both non-derivative and derivative claims or commitments,

as detailed below.

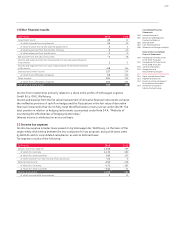

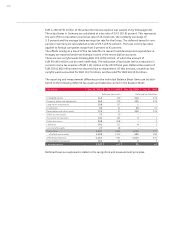

Non-derivative financial instruments

The “Loans and receivables” and “Financial liabilities measured at amortized cost” categories

include non-derivative financial instruments measured at amortized cost. These include, in

particular:

– loans advanced,

– trade receivables and payables,

– other current assets and liabilities,

– financial liabilities,

– cash and cash equivalents.

Assets and liabilities in foreign currency are measured at the exchange rate on the reporting

date.

In the case of current items, the fair values to be additionally indicated in the Notes correspond

to the amortized cost. For non-current assets and liabilities with more than one year to matu-

rity, fair values are determined by discounting future cash flows at market rates.

Liabilities from financial lease agreements are carried at the present value of the leasing

installments.

“Available-for-sale financial assets” include non-derivative financial instruments that are desig-

nated as such or that cannot be allocated to any other IAS 39 category, and are as a general rule

carried at fair value. Securities and other financial assets that are not valued according to the

equity method both fall into this category.

In the case of listed financial instruments – exclusively securities in the case of the Audi Group –

the fair value corresponds to its market value on the balance sheet date.