Audi 2010 Annual Report Download - page 200

Download and view the complete annual report

Please find page 200 of the 2010 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263

|

|

198

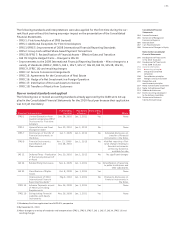

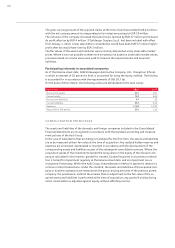

The gross carrying amount of the acquired claims at the time of purchase totaled EUR 42 million,

with the net carrying amount (corresponding to fair value) amounting to EUR 39 million.

The inclusion of the company increased the Audi Group’s revenue by EUR 37 million and reduced

its profit after tax by EUR 4 million. If Italdesign Giugiaro S.p.A. had been included with effect

from January 1, 2010, Group sales before consolidation would have been EUR 57 million higher;

profit after tax would have risen by EUR 3 million.

The fair values of the assets and liabilities were primarily determined using observable market

prices. Where it was not possible to determine a market price based on observable market values,

processes based on income value were used to measure the acquired assets and assumed

liabilities.

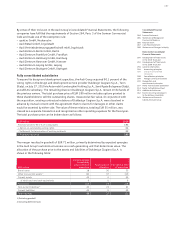

Participating interests in associated companies

As of the balance sheet date, FAW-Volkswagen Automotive Company, Ltd., Changchun (China),

in which an interest of 10 percent is held, is accounted for using the equity method. The holding

is accounted for in accordance with the requirements of IAS 28.7 (a).

On the basis of this interest, the following values are attributable to the Audi Group:

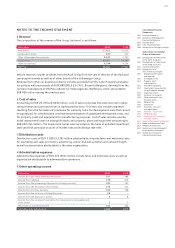

EUR million 2010 2009

Non-current assets 252 187

Current assets 733 404

Non-current liabilities 67 53

Current liabilities 592 324

Revenues 1,748 1,232

Net profit for the period 220 110

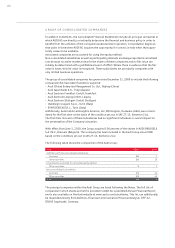

CONSOLIDATION PRINCIPLES

The assets and liabilities of the domestic and foreign companies included in the Consolidated

Financial Statements are recognized in accordance with the standard accounting and measure-

ment policies of the Audi Group.

In the case of subsidiaries that are being consolidated for the first time, the assets and liabilities

are to be measured at their fair value at the time of acquisition. Any realized hidden reserves and

expenses are amortized, depreciated or reversed in accordance with the development of the

corresponding assets and liabilities as part of the subsequent consolidation process. Where the

acquisition values of the investments exceed the Group share in the equity of the relevant com-

pany as calculated in this manner, goodwill is created. Goodwill acquired in a business combina-

tion is tested for impairment regularly at the balance sheet date, and an impairment loss is

recognized if necessary. Within the Audi Group, the predecessor method is applied in relation to

common control transactions. Under this method, the assets and liabilities of the acquired com-

pany or business operations are measured at the gross carrying amounts of the previous parent

company. The predecessor method thus means that no adjustment to the fair value of the ac-

quired assets and liabilities is performed at the time of acquisition; any goodwill arising during

initial consolidation is adjusted against equity, without affecting income.