Audi 2010 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2010 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

137

Management Report

132 Audi Group

132 Structure

134 Strategy

137 Shares

138 Disclosures required under

takeover law

140 Corporate management

declaration

140 Compliance

141 System of remuneration for

the Supervisory Board and

Board of Management

141 Business and underlying

situation

156 Financial performance

indicators

159 Social and ecological aspects

173 Risks, opportunities

and outlook

183 Disclaimer

As well as being able to offer them challenging tasks, the Audi Group provides its personnel with

attractive working conditions, commensurate pay and high job security.

Regular internal surveys of the workforce confirm a high level of employee satisfaction. Numerous

external surveys have additionally confirmed the high appeal of the Audi Group as an employer –

in 2010 AUDI AG was voted the most attractive employer in such leading graduate surveys as

those conducted by the consultants trendence and Universum among both engineering and

business students (“trendence Graduate Barometer 2010 – Business and Engineering Edition,”

May 21, 2010; “Universum Student Survey 2010 – Germany,” May 3, 2010).

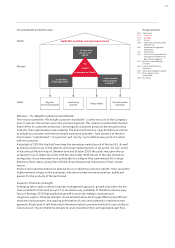

Strategic target

One of the Audi Group’s principal objectives is to consistently increase the value of the Company.

The return on investment (RoI) is used as an instrument of internal steering to evaluate the

return on the capital employed for different types and scales of investment project. The return

on investment reflects the development in a company’s profitability and is calculated using the

following formula:

Operating profit after tax

Average invested assets

Return on investment (RoI) = x 100

EUR million 2010 2009

Operating profit after tax 2,338 1,123

Average operating assets 13,327 13,329

– Average non-interest-bearing liabilities 3,855 3,557

= Average invested assets 9,472 9,772

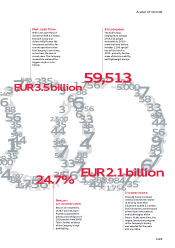

Return on investment (in %) 24.7 11.5

The return on investment of 24.7 percent was both higher than in the previous year (11.5 percent)

and up on the previous record level dating from 2008 (19.8 percent). In terms of return on

investment, the Audi Group therefore ranks as one of the most profitable companies in the

automotive industry worldwide.

SHARES

Stock market developments

In the early part of 2010 the situation on international stock and capital markets was dominated

by the loss of confidence in the stability of the budgets of certain EU countries with large budget

deficits. Concerns about the possible consequences of Greece’s sovereign debt spilling over into

the banking sector and into the European real economy undermined morale. Against this back-

drop international stock markets suffered significant downturns, with particularly high losses in

the trading prices of financial institutes. Then, from mid-2010, stock markets worldwide by and

large staged a recovery. Underpinned by the brighter economic prospects and increasingly posi-

tive profit forecasts, trading prices picked up again. The positive trend was further bolstered by

companies’ surprisingly good quarterly figures. Trading prices worldwide therefore continued to

climb through the end of 2010.

German stock markets were initially dominated by price losses at the start of the year. The German

Share Index DAX touched its year-low of 5,434 points in February 2010 – a loss of around

ten percent compared with the start of the year. The German stock market rallied from March

on, at first very strongly. The lead index then moved sideways up until the end of the third quarter,

amid high volatility. In the final quarter the index once more made appreciable gains, reaching

a year-high of 7,078 points on December 21. The DAX closed the year on 6,914 points, almost

16 percent up on the position at the start of 2010.