Audi 2010 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2010 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

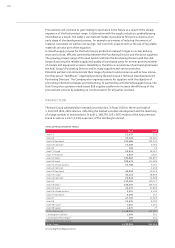

141

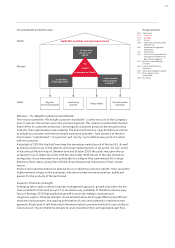

Management Report

132 Audi Group

132 Structure

134 Strategy

137 Shares

138 Disclosures required under

takeover law

140 Corporate management

declaration

140 Compliance

141 System of remuneration for

the Supervisory Board and

Board of Management

141 Business and underlying

situation

141 Economic environment

143 Research and development

147 Procurement

148 Production

150 Deliveries and distribution

156 Financial performance

indicators

159 Social and ecological aspects

173 Risks, opportunities

and outlook

183 Disclaimer

SYSTEM OF REMUNERATION FOR THE SUPERVISORY BOARD AND

BOARD OF MANAGEMENT

Information on the system of remuneration for the Supervisory Board and Board of Management

is provided in the Notes to the Consolidated Financial Statements under “Details relating to the

Supervisory Board and Board of Management” and constitutes part of the Group Management

Report.

BUSINESS AND UNDERLYING SITUATION

ECONOMIC ENVIRONMENT

Global economic situation

2010 saw the global economy recover unexpectedly quickly from the global economic crisis,

even if the speed of the upturn slowed somewhat in the second half of the year. In 2010 as a

whole, global economic output grew by 4.1 (– 1.9) percent. This development owed much to

expansive monetary policies worldwide, as well as to the rapid progress of emerging countries,

most notably China. By contrast, the economic recovery in many industrial countries was weaker.

Despite price increases for energy and raw materials, the inflation rate in most countries re-

mained low.

The economy in Western Europe expanded by 1.8 (– 4.1) percent in 2010, with the debt crisis

clouding the economic environment throughout the whole year. Gross domestic product grew

by 1.5 (– 4.9) percent in the UK, by 1.5 (– 2.5) percent as well in France and by 1.0 (– 5.1) percent

in Italy. Spain, on the other hand, remained in recession with economic output falling by

– 0.2 (– 3.7) percent.

Germany recovered surprisingly fast in 2010, with economic growth reaching 3.6 (– 4.7) percent.

The economy benefited in particular from high export demand and a recovery in consumer

spending thanks to the improved state of the labor market and higher consumer confidence.

Most Central and Eastern European countries regained a course of moderate growth in the year

under review. In particular the Russian economy enjoyed clear expansion of 4.0 (– 7.9) percent

thanks to higher exports of raw materials.

In the United States, the economy cooled in the course of the year after having made a good

start. Private consumer spending in particular remained muted because of high unemployment.

Overall, gross domestic product in the United States grew by 2.9 (– 2.6) percent in 2010.

In Latin America the economic situation improved markedly in 2010. Above all in Brazil and

Argentina, gross domestic product bounced back with growth rates of 7.5 (– 0.6) and 8.3 (0.9)

percent.

Asia’s emerging countries, the economies of which had already been expanding again since early

2009, achieved the highest economic growth rates anywhere in the world during the period

under review. In China, gross domestic product was up 10.3 (9.2) percent, while the Indian

economy likewise grew vigorously by 8.5 (6.5) percent.

Following the sharp slump in the economy in the previous year, Japan regained an upward trend

in 2010 and achieved economic growth of 4.3 (– 6.3) percent mainly thanks to increased export

demand.

International car market

Global demand for cars exhibited a marked upward trend in 2010, on the back of the global

economic upturn, and gained 11.4 percent to 58.7 (52.7) million passenger cars. The power-

houses of growth were principally the Asian car markets, which expanded at a rapid rate. The

car market moreover improved in the United States and in the major Latin American markets.

By contrast, demand for passenger cars in Western Europe remained weak.