Allstate 2014 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2014 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

9MAR201204034531

Appendix D

DEFINITIONS OF NON-GAAP MEASURES

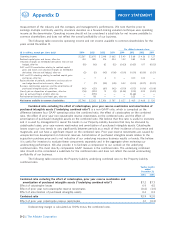

Measures that are not based on accounting principles generally accepted in the United States of America

(‘‘non-GAAP’’) are defined and reconciled to the most directly comparable GAAP measure. We believe that

investors’ understanding of Allstate’s performance is enhanced by our disclosure of the following non-GAAP

measures. Our methods for calculating these measures may differ from those used by other companies and

therefore comparability may be limited.

Operating income (‘‘operating profit’’) is net income available to common shareholders, excluding:

• realized capital gains and losses, after-tax, except for periodic settlements and accruals on

non-hedge derivative instruments, which are reported with realized capital gains and losses but

included in operating income,

• valuation changes on embedded derivatives that are not hedged, after-tax,

• amortization of deferred policy acquisition costs (‘‘DAC’’) and deferred sales inducements (‘‘DSI’’),

to the extent they resulted from the recognition of certain realized capital gains and losses or

valuation changes on embedded derivatives that are not hedged, after-tax,

• business combination expenses and the amortization of purchased intangible assets, after-tax,

• gain (loss) on disposition of operations, after-tax, and

• adjustments for other significant non-recurring, infrequent or unusual items, when (a) the nature of

the charge or gain is such that it is reasonably unlikely to recur within two years, or (b) there has

been no similar charge or gain within the prior two years.

Net income available to common shareholders is the GAAP measure that is most directly comparable to

operating income.

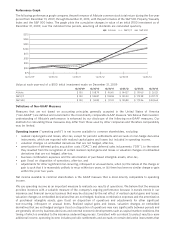

We use operating income as an important measure to evaluate our results of operations. We believe that

the measure provides investors with a valuable measure of the company’s ongoing performance because it reveals

trends in our insurance and financial services business that may be obscured by the net effect of realized capital

gains and losses, valuation changes on embedded derivatives that are not hedged, business combination expenses

and the amortization of purchased intangible assets, gain (loss) on disposition of operations and adjustments for

other significant non-recurring, infrequent or unusual items. Realized capital gains and losses, valuation changes on

embedded derivatives that are not hedged and gain (loss) on disposition of operations may vary significantly

between periods and are generally driven by business decisions and external economic developments such as

capital market conditions, the timing of which is unrelated to the insurance underwriting process. Consistent with

our intent to protect results or earn additional income, operating income includes periodic settlements and

accruals on certain derivative instruments that are reported in realized capital gains and losses because they do

not qualify for hedge accounting or are not designated as hedges for accounting purposes. These instruments are

used for economic hedges and to replicate fixed income securities, and by including them in operating income, we

are appropriately reflecting their trends in our performance and in a manner consistent with the economically

hedged investments, product attributes (e.g. net investment income and interest credited to contractholder funds)

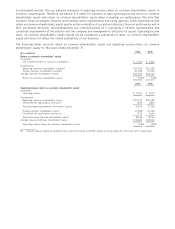

or replicated investments. Business combination expenses are excluded because they are non-recurring in nature

and the amortization of purchased intangible assets is excluded because it relates to the acquisition purchase

price and is not indicative of our underlying insurance business results or trends. Non-recurring items are excluded

because, by their nature, they are not indicative of our business or economic trends. Accordingly, operating

income excludes the effect of items that tend to be highly variable from period to period and highlights the results

from ongoing operations and the underlying profitability of our business. A byproduct of excluding these items to

determine operating income is the transparency and understanding of their significance to net income variability

and profitability while recognizing these or similar items may recur in subsequent periods. Operating income is

used by management along with the other components of net income available to common shareholders to assess

our performance. We use adjusted measures of operating income in incentive compensation. Therefore, we believe

it is useful for investors to evaluate net income available to common shareholders, operating income and their

components separately and in the aggregate when reviewing and evaluating our performance. We note that

investors, financial analysts, financial and business media organizations and rating agencies utilize operating

income results in their evaluation of our and our industry’s financial performance and in their investment

decisions, recommendations and communications as it represents a reliable, representative and consistent

D-1

PROXY STATEMENT

The Allstate Corporation