Allstate 2014 Annual Report Download - page 126

Download and view the complete annual report

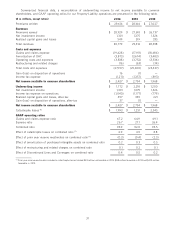

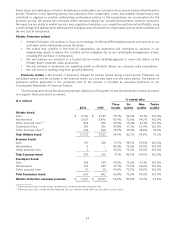

Please find page 126 of the 2014 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.extensive data and stochastic modeling of actuarial chain ladder methodologies used to develop reserve estimates, we

estimate that the potential variability of our Allstate Protection reserves, excluding reserves for catastrophe losses,

within a reasonable probability of other possible outcomes, may be approximately plus or minus 4%, or plus or minus

$500 million in net income available to common shareholders. A lower level of variability exists for auto injury losses,

which comprise approximately 80% of reserves, due to their relatively stable development patterns over a longer

duration of time required to settle claims. Other types of losses, such as auto physical damage, homeowners losses and

other personal lines losses, which comprise about 20% of reserves, tend to have greater variability but are settled in a

much shorter period of time. Although this evaluation reflects most reasonably likely outcomes, it is possible the final

outcome may fall below or above these amounts. Historical variability of reserve estimates is reported in the Property-

Liability Claims and Claims Expense Reserves section of this document.

Reserves for Michigan and New Jersey unlimited personal injury protection Property-Liability claims and claims

expense reserves include reserves for Michigan unlimited personal injury protection (‘‘PIP’’) which is a mandatory

coverage that provides unlimited personal injury protection to covered insureds involved in certain auto and motorcycle

accidents. The administration of this program is through a private, non-profit association created by the state of

Michigan, the Michigan Catastrophic Claim Association (‘‘MCCA’’). Due to increasing costs of providing healthcare

related to serious injuries and advances in medical care extending the duration of treatment, the estimation processes

have been enhanced and assumptions for this reserve balance have been contemporized to the current validated

conditions.

The process that resulted in an increase in MCCA covered losses involved a number of activities that occurred over

multiple years and included the comprehensive review and interpretation of MCCA actuarial reports, other MCCA

members’ reports and our PIP loss trends which have increased in severity over time. To address this exposure, we

refined our ultimate claim reserve estimation techniques in 2011 through 2014, including relying more on paid loss

development methods and increasing our view of future claim development and longevity of claimants, as a result of

conducting comprehensive claim file reviews to develop case reserve type estimates of specific claims and other

estimation refinements. In 2014 we completed the multi-year comprehensive review and incorporated the findings into

our reserve estimation factors. We report our paid and unpaid claims and case reserves, which include our best estimate

of the ultimate claim cost, excluding IBNR to the MCCA based on their requirements. The MCCA does not provide

participating companies with its estimate of a company’s claim costs.

We provide similar PIP coverage in New Jersey for auto policies issued or renewed in New Jersey prior to 1991 that is

administered by the New Jersey Unsatisfied Claim and Judgment Fund (‘‘NJUCJF’’). In 2013, we adopted similar

actuarial estimating techniques as for the MCCA exposures to estimate loss reserves for unlimited PIP coverage for

policies covered by the NJUCJF. The NJUCJF was merged into the New Jersey Property Liability Guaranty Association

who collects the assessments. Upon completion of our comprehensive review in 2014, we updated our reserve

estimation techniques and factors, similar to the processes followed to develop the MCCA reserves, which resulted in

an increase in reserves for unlimited PIP coverage for policies covered by the NJUCJF.

Reserve estimates by their nature are very complex to determine and subject to significant judgments, and do not

represent an exact determination for each outstanding claim. As actual claims, paid losses and/or case reserve results

emerge, our estimate of the ultimate cost to settle may be materially greater or less than previously estimated amounts.

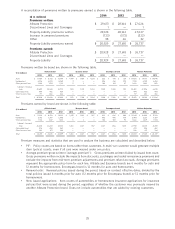

Adequacy of reserve estimates We believe our net claims and claims expense reserves are appropriately

established based on available methodologies, facts, technology, laws and regulations. We calculate and record a single

best reserve estimate, in conformance with generally accepted actuarial standards, for each line of insurance, its

components (coverages and perils) and state, for reported losses and for IBNR losses, and as a result we believe that no

other estimate is better than our recorded amount. Due to the uncertainties involved, the ultimate cost of losses may

vary materially from recorded amounts, which are based on our best estimates.

Discontinued Lines and Coverages reserve estimates

Characteristics of Discontinued Lines exposure Our exposure to asbestos, environmental and other discontinued

lines claims arises principally from assumed reinsurance coverage written during the 1960s through the mid-1980s,

including reinsurance on primary insurance written on large U.S. companies, and from direct excess insurance written

from 1972 through 1985, including substantial excess general liability coverages on large U.S. companies. Additional

exposure stems from direct primary commercial insurance written during the 1960s through the mid-1980s. Asbestos

claims relate primarily to bodily injuries asserted by people who were exposed to asbestos or products containing

asbestos. Environmental claims relate primarily to pollution and related clean-up costs. Other discontinued lines

exposures primarily relate to general liability and product liability mass tort claims, such as those for medical devices

26