Allstate 2014 Annual Report Download - page 184

Download and view the complete annual report

Please find page 184 of the 2014 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

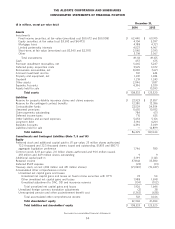

CAPITAL RESOURCES AND LIQUIDITY

Capital resources consist of shareholders’ equity and debt, representing funds deployed or available to be deployed

to support business operations or for general corporate purposes. The following table summarizes our capital resources

as of December 31.

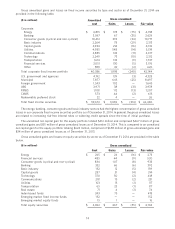

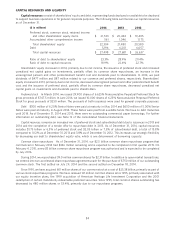

($ in millions) 2014 2013 2012

Preferred stock, common stock, retained income

and other shareholders’ equity items $ 21,743 $ 20,434 $ 19,405

Accumulated other comprehensive income 561 1,046 1,175

Total shareholders’ equity 22,304 21,480 20,580

Debt 5,194 6,201 6,057

Total capital resources $ 27,498 $ 27,681 $ 26,637

Ratio of debt to shareholders’ equity 23.3% 28.9% 29.4%

Ratio of debt to capital resources 18.9% 22.4% 22.7%

Shareholders’ equity increased in 2014, primarily due to net income, the issuance of preferred stock and increased

unrealized net capital gains on investments, partially offset by common share repurchases, an increase in the

unrecognized pension and other postretirement benefit cost and dividends paid to shareholders. In 2014, we paid

dividends of $477 million and $87 million related to our common and preferred shares, respectively. Shareholders’

equity increased in 2013, primarily due to net income, decreased unrecognized pension and other postretirement benefit

cost, and the issuance of preferred stock, partially offset by common share repurchases, decreased unrealized net

capital gains on investments and dividends paid to shareholders.

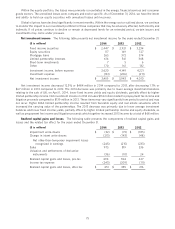

Preferred stock In March 2014, we issued 29,900 shares of 6.625% Noncumulative Perpetual Preferred Stock for

gross proceeds of $747.5 million. In June 2014, we issued 10,000 shares of 6.25% Noncumulative Perpetual Preferred

Stock for gross proceeds of $250 million. The proceeds of both issuances were used for general corporate purposes.

Debt $300 million of 6.20% Senior Notes were paid at maturity in May 2014 and $650 million of 5.00% Senior

Notes were paid at maturity in August 2014. These Notes were paid from available funds. We have no debt maturities

until 2018. As of December 31, 2014 and 2013, there were no outstanding commercial paper borrowings. For further

information on outstanding debt, see Note 12 of the consolidated financial statements.

Capital resources comprise an increased mix of preferred stock and subordinated debt due to issuances in 2013 and

2014 and the completion of a tender offer to repurchase debt in 2013. As of December 31, 2014, capital resources

includes $1.75 billion or 6.3% of preferred stock and $2.05 billion or 7.5% of subordinated debt, a total of 13.8%

compared to 10.2% as of December 31, 2013 and 3.8% as of December 31, 2012. This increases our strategic flexibility

by decreasing our debt to shareholders’ equity ratio, which is one determinant of borrowing capacity.

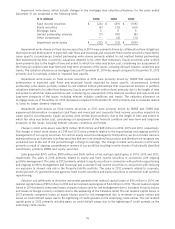

Common share repurchases As of December 31, 2014, our $2.5 billion common share repurchase program that

commenced in February 2014 had $336 million remaining and is expected to be completed in first quarter 2015. On

February 4, 2015, a new $3 billion common share repurchase program was authorized and is expected to be completed

by July 2016.

During 2014, we repurchased 39.0 million common shares for $2.31 billion. In addition to open market transactions,

we entered into two accelerated share repurchase agreements each for the purchase of $750 million of our outstanding

common stock. The first settled on July 29, 2014 and the second settled on December 18, 2014.

Since 1995, we have acquired 601 million shares of our common stock at a cost of $25.38 billion, primarily as part of

various stock repurchase programs. We have reissued 121 million common shares since 1995, primarily associated with

our equity incentive plans, the 1999 acquisition of American Heritage Life Investment Corporation and the 2001

redemption of certain mandatorily redeemable preferred securities. Since 1995, total common shares outstanding has

decreased by 480 million shares or 53.4%, primarily due to our repurchase programs.

84