Allstate 2014 Annual Report Download - page 154

Download and view the complete annual report

Please find page 154 of the 2014 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

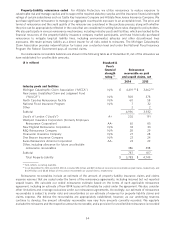

Property-Liability reinsurance ceded For Allstate Protection, we utilize reinsurance to reduce exposure to

catastrophe risk and manage capital, and to support the required statutory surplus and the insurance financial strength

ratings of certain subsidiaries such as Castle Key Insurance Company and Allstate New Jersey Insurance Company. We

purchase significant reinsurance to manage our aggregate countrywide exposure to an acceptable level. The price and

terms of reinsurance and the credit quality of the reinsurer are considered in the purchase process, along with whether

the price can be appropriately reflected in the costs that are considered in setting future rates charged to policyholders.

We also participate in various reinsurance mechanisms, including industry pools and facilities, which are backed by the

financial resources of the property-liability insurance company market participants, and have historically purchased

reinsurance to mitigate long-tail liability lines, including environmental, asbestos and other discontinued lines

exposures. We retain primary liability as a direct insurer for all risks ceded to reinsurers. The Michigan Catastrophic

Claim Association provides indemnification for losses over a retention level and under the National Flood Insurance

Program the Federal Government pays all covered claims.

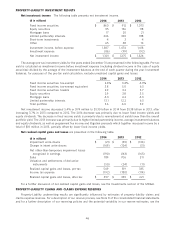

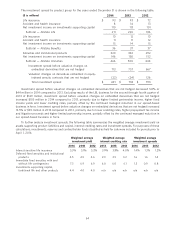

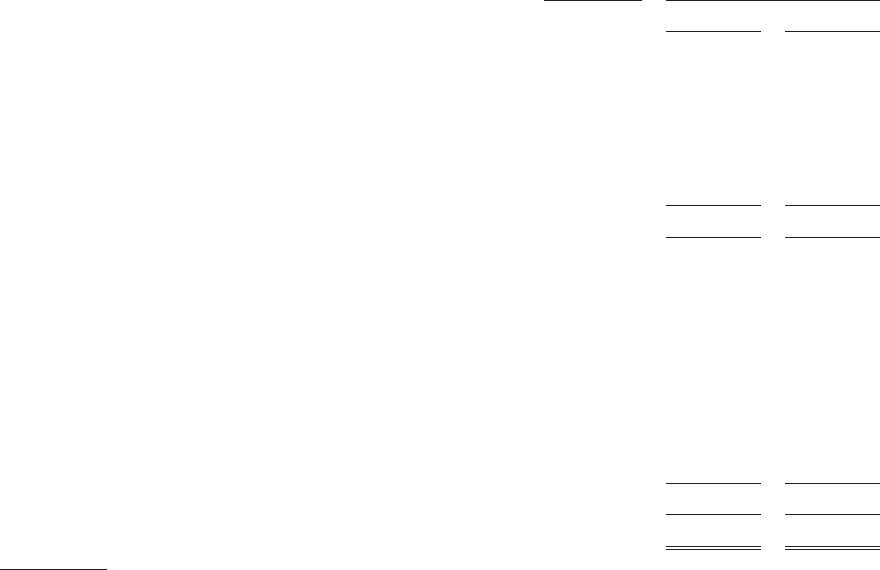

Our reinsurance recoverable balances are shown in the following table as of December 31, net of the allowance we

have established for uncollectible amounts.

($ in millions) Standard &

Poor’s

financial Reinsurance

strength recoverable on paid

rating (1) and unpaid claims, net

2014 2013

Industry pools and facilities

Michigan Catastrophic Claim Association (‘‘MCCA’’) N/A $ 4,419 (2) $ 3,462 (2)

New Jersey Unsatisfied Claim and Judgment Fund

(‘‘NJUCJF’’) N/A 508 378

North Carolina Reinsurance Facility N/A 60 58

National Flood Insurance Program N/A 7 32

Other 22

Subtotal 4,996 3,932

Lloyd’s of London (‘‘Lloyd’s’’) A+ 202 191

Westport Insurance Corporation (formerly Employers

Reinsurance Corporation) AA- 65 85

New England Reinsurance Corporation N/A 33 33

R&Q Reinsurance Company N/A 28 29

Clearwater Insurance Company N/A 27 28

One Beacon Insurance Company N/A 23 24

Swiss Reinsurance America Corporation AA- 23 29

Other, including allowance for future uncollectible

reinsurance recoverables 386 398

Subtotal 787 817

Total Property-Liability $ 5,783 $ 4,749

(1) N/A reflects no rating available.

(2) As of December 31, 2014 and 2013, MCCA includes $32 million and $29 million of reinsurance recoverable on paid claims, respectively, and

$4.39 billion and $3.43 billion of reinsurance recoverable on unpaid claims, respectively.

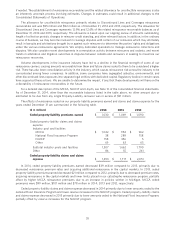

Reinsurance recoverables include an estimate of the amount of property-liability insurance claims and claims

expense reserves that are ceded under the terms of the reinsurance agreements, including incurred but not reported

unpaid losses. We calculate our ceded reinsurance estimate based on the terms of each applicable reinsurance

agreement, including an estimate of how IBNR losses will ultimately be ceded under the agreement. We also consider

other limitations and coverage exclusions under our reinsurance agreements. Accordingly, our estimate of reinsurance

recoverables is subject to similar risks and uncertainties as our estimate of reserves for property-liability claims and

claims expense. We believe the recoverables are appropriately established; however, as our underlying reserves

continue to develop, the amount ultimately recoverable may vary from amounts currently recorded. We regularly

evaluate the reinsurers and the respective amounts recoverable, and a provision for uncollectible reinsurance is recorded

54