Allstate 2014 Annual Report Download - page 216

Download and view the complete annual report

Please find page 216 of the 2014 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

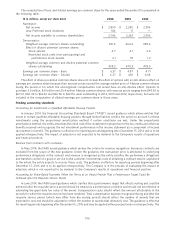

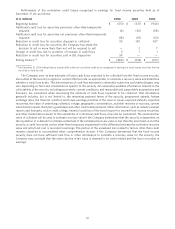

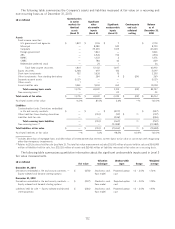

The types of properties collateralizing the mortgage loans as of December 31 are as follows:

(% of mortgage loan portfolio carrying value) 2014 2013

Office buildings 24.3% 26.5%

Apartment complex 23.3 23.2

Retail 22.2 21.0

Warehouse 17.8 18.0

Other 12.4 11.3

Total 100.0% 100.0%

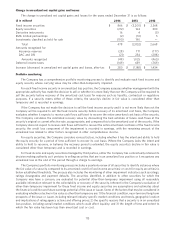

The contractual maturities of the mortgage loan portfolio as of December 31, 2014 are as follows:

($ in millions) Number of Carrying

loans value Percent

2015 21 $ 249 5.9%

2016 37 398 9.5

2017 37 419 10.0

2018 36 459 11.0

Thereafter 190 2,663 63.6

Total 321 $ 4,188 100.0%

Mortgage loans are evaluated for impairment on a specific loan basis through a quarterly credit monitoring process

and review of key credit quality indicators. Mortgage loans are considered impaired when it is probable that the

Company will not collect the contractual principal and interest. Valuation allowances are established for impaired loans

to reduce the carrying value to the fair value of the collateral less costs to sell or the present value of the loan’s expected

future repayment cash flows discounted at the loan’s original effective interest rate. Impaired mortgage loans may not

have a valuation allowance when the fair value of the collateral less costs to sell is higher than the carrying value.

Valuation allowances are adjusted for subsequent changes in the fair value of the collateral less costs to sell. Mortgage

loans are charged off against their corresponding valuation allowances when there is no reasonable expectation of

recovery. The impairment evaluation is non-statistical in respect to the aggregate portfolio but considers facts and

circumstances attributable to each loan. It is not considered probable that additional impairment losses, beyond those

identified on a specific loan basis, have been incurred as of December 31, 2014.

Accrual of income is suspended for mortgage loans that are in default or when full and timely collection of principal

and interest payments is not probable. Cash receipts on mortgage loans on nonaccrual status are generally recorded as

a reduction of carrying value.

Debt service coverage ratio is considered a key credit quality indicator when mortgage loans are evaluated for

impairment. Debt service coverage ratio represents the amount of estimated cash flows from the property available to

the borrower to meet principal and interest payment obligations. Debt service coverage ratio estimates are updated

annually or more frequently if conditions are warranted based on the Company’s credit monitoring process.

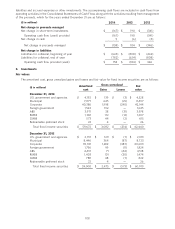

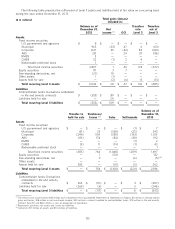

The following table reflects the carrying value of non-impaired fixed rate and variable rate mortgage loans

summarized by debt service coverage ratio distribution as of December 31:

2014 2013

($ in millions)

Fixed rate Variable rate Fixed rate Variable rate

mortgage mortgage mortgage mortgage

Debt service coverage ratio loans loans Total loans loans Total

distribution

Below 1.0 $ 110 $ — $ 110 $ 153 $ — $ 153

1.0 - 1.25 424 — 424 613 — 613

1.26 - 1.50 1,167 1 1,168 1,233 2 1,235

Above 1.50 2,450 20 2,470 2,562 77 2,639

Total non-impaired mortgage loans $ 4,151 $ 21 $ 4,172 $ 4,561 $ 79 $ 4,640

Mortgage loans with a debt service coverage ratio below 1.0 that are not considered impaired primarily relate to

instances where the borrower has the financial capacity to fund the revenue shortfalls from the properties for the

foreseeable term, the decrease in cash flows from the properties is considered temporary, or there are other risk

mitigating circumstances such as additional collateral, escrow balances or borrower guarantees.

116