Allstate 2014 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2014 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Other personal lines sold under the Allstate brand include renter, condominium, landlord, boat, umbrella and

manufactured home insurance policies. Commercial lines include insurance products for small business owners. Other

business lines include Allstate Roadside Services that provides roadside assistance products, including Good Hands

Roadside姞; Allstate Dealer Services that provides service contracts and other products sold in conjunction with auto

lending and vehicle sales transactions; and Ivantage that is a general agency for Allstate exclusive agencies.

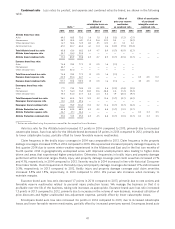

Our strategy for the Esurance brand focuses on self-directed consumers. To best serve these customers, Esurance

develops its technology, website and mobile capabilities to continuously improve its hassle-free purchase and claims

experience and offer innovative product options and features. Esurance continues to develop additional products to

complement its auto line of business and provide a more comprehensive solution to its customers. Esurance also

continues to invest in geographic expansion of its products. Esurance expanded its renter product in 2014 from 16 to 19

states, motorcycle from 6 to 11 states, homeowners from 3 to 14 states and auto from 41 to 43 states. Esurance

continues to focus on increasing its preferred driver mix, while raising advertising expenditures and marketing

effectiveness to support growth. Esurance’s DriveSense姞 program, available in 28 states as of December 31, 2014,

enables participating customers to be eligible for discounts based on driving performance as measured by a device

installed in the vehicle. Esurance’s DriveSafe姞 program is designed to help parents coach teens on safe driving by

providing customizable driving statistics and the ability to limit cell phone use while the car is in motion, all controlled by

a device installed in the vehicle.

Our strategy for the Encompass brand centers around a highly differentiated offering which simplifies the insurance

experience by packaging a product with broader coverage and higher limits into a single annual household (‘‘package’’)

policy with one premium, one bill, one property deductible, one renewal date and one advisor — an independent

insurance agent. It especially appeals to the approximately 35 million mass affluent households in the U.S., with their

higher average premiums and preference for professional advice regarding coverage needs and risk solutions. Package

policies represent over 80% of the Encompass portfolio of business, with concentrations in suburban and urban areas

throughout the country. Package policies currently are not offered in Massachusetts, North Carolina and Texas. In

pursuit of this strategy and to achieve its financial objectives, Encompass is seeking to diversify through new business

writings in states where the risk return opportunities meet its requirements, while aggressively executing pricing,

underwriting, and other actions to manage risk and ensure adequate profitability.

Answer Financial, an independent personal lines insurance agency, serves self-directed, brand-neutral consumers

who want a choice between insurance carriers and offers comparison quotes for auto and homeowners insurance from

approximately 25 insurance companies through its website and over the phone. It receives commissions for this service.

Our pricing and underwriting strategies and decisions for all of our brands are primarily designed to achieve

appropriate returns along with enhancing our competitive position. Our sophisticated pricing methodology allows us to

attract and retain multiple risk segments. A combination of underwriting information, pricing and discounts are used to

achieve a more competitive position. Our pricing uses a number of risk evaluation factors including insurance scoring, to

the extent permissible by applicable law, based on information that is obtained from credit reports, and other factors.

Our pricing strategy involves marketplace pricing and underwriting decisions that are based on these risk evaluation

models and an evaluation of competitors.

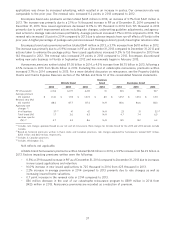

We continue to manage our property catastrophe exposure with the goal of providing shareholders an acceptable

return on the risks assumed in our property business and to reduce the variability of our earnings. Our property business

includes personal homeowners, commercial property and other property insurance lines. As of December 31, 2014, we

have less than a 1% likelihood of exceeding average annual aggregate catastrophe losses by $2 billion, net of

reinsurance, from hurricanes and earthquakes, based on modeled assumptions and applications currently available. The

use of different assumptions and updates to industry models, and updates to our risk transfer program, could materially

change the projected loss. Our growth strategies include areas previously restricted where we believe we can earn an

appropriate return for the risk and as a result our exposure may increase, but remain lower than $2 billion as noted

above. In addition, we have exposure to severe weather events which impact catastrophe losses.

Property catastrophe exposure management includes purchasing reinsurance to provide coverage for known

exposure to hurricanes, earthquakes, wildfires, fires following earthquakes and other catastrophes. We are also working

to promote measures to prevent and mitigate losses and make homes and communities more resilient, including

enactment of stronger building codes and effective enforcement of those codes, adoption of sensible land use policies,

and development of effective and affordable methods of improving the resilience of existing structures.

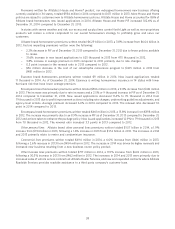

Pricing of property products is typically intended to establish returns that we deem acceptable over a long-term

period. Losses, including losses from catastrophic events and weather-related losses (such as wind, hail, lightning and

33