Allstate 2014 Annual Report Download - page 211

Download and view the complete annual report

Please find page 211 of the 2014 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280

|

|

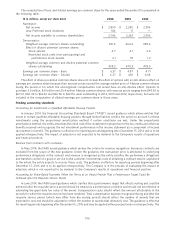

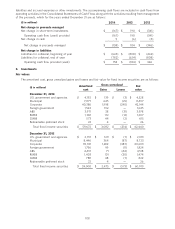

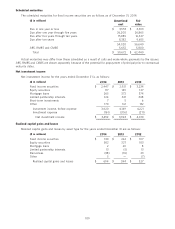

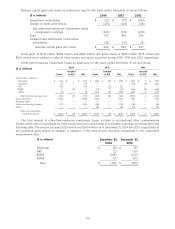

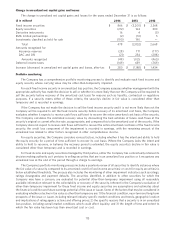

Rollforwards of the cumulative credit losses recognized in earnings for fixed income securities held as of

December 31 are as follows:

($ in millions) 2014 2013 2012

Beginning balance $ (513) $ (617) $ (944)

Additional credit loss for securities previously other-than-temporarily

impaired (6) (30) (58)

Additional credit loss for securities not previously other-than-temporarily

impaired (18) (19) (50)

Reduction in credit loss for securities disposed or collected 95 150 427

Reduction in credit loss for securities the Company has made the

decision to sell or more likely than not will be required to sell — 2 7

Change in credit loss due to accretion of increase in cash flows 3 1 1

Reduction in credit loss for securities sold in LBL disposition 59 — —

Ending balance (1) $ (380) $ (513) $ (617)

(1) The December 31, 2013 ending balance includes $60 million of cumulative credit losses recognized in earnings for fixed income securities that are

classified as held for sale.

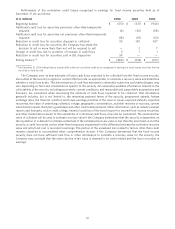

The Company uses its best estimate of future cash flows expected to be collected from the fixed income security,

discounted at the security’s original or current effective rate, as appropriate, to calculate a recovery value and determine

whether a credit loss exists. The determination of cash flow estimates is inherently subjective and methodologies may

vary depending on facts and circumstances specific to the security. All reasonably available information relevant to the

collectability of the security, including past events, current conditions, and reasonable and supportable assumptions and

forecasts, are considered when developing the estimate of cash flows expected to be collected. That information

generally includes, but is not limited to, the remaining payment terms of the security, prepayment speeds, foreign

exchange rates, the financial condition and future earnings potential of the issue or issuer, expected defaults, expected

recoveries, the value of underlying collateral, vintage, geographic concentration, available reserves or escrows, current

subordination levels, third party guarantees and other credit enhancements. Other information, such as industry analyst

reports and forecasts, sector credit ratings, financial condition of the bond insurer for insured fixed income securities,

and other market data relevant to the realizability of contractual cash flows, may also be considered. The estimated fair

value of collateral will be used to estimate recovery value if the Company determines that the security is dependent on

the liquidation of collateral for ultimate settlement. If the estimated recovery value is less than the amortized cost of the

security, a credit loss exists and an other-than-temporary impairment for the difference between the estimated recovery

value and amortized cost is recorded in earnings. The portion of the unrealized loss related to factors other than credit

remains classified in accumulated other comprehensive income. If the Company determines that the fixed income

security does not have sufficient cash flow or other information to estimate a recovery value for the security, the

Company may conclude that the entire decline in fair value is deemed to be credit related and the loss is recorded in

earnings.

111