Allstate 2014 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2014 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

mortality or morbidity risk. Contract charges are revenues generated from interest-sensitive and variable life insurance

and fixed annuities for which deposits are classified as contractholder funds or separate account liabilities. Contract

charges are assessed against the contractholder account values for maintenance, administration, cost of insurance and

surrender prior to contractually specified dates.

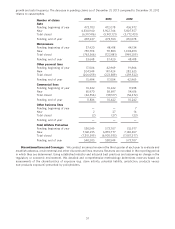

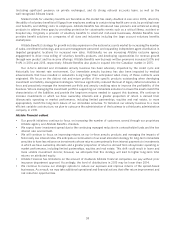

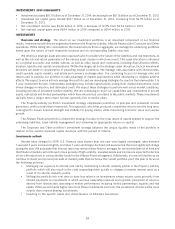

The following table summarizes life and annuity premiums and contract charges by product for the years ended

December 31.

($ in millions) 2014 2013 2012

Underwritten products

Traditional life insurance premiums $ 476 $ 455 $ 434

Accident and health insurance premiums 8 26 26

Interest-sensitive life insurance contract charges 781 991 969

Subtotal — Allstate Life 1,265 1,472 1,429

Traditional life insurance premiums 35 36 36

Accident and health insurance premiums 736 694 627

Interest-sensitive life insurance contract charges 98 95 86

Subtotal — Allstate Benefits 869 825 749

Total underwritten products 2,134 2,297 2,178

Annuities

Immediate annuities with life contingencies premiums 4 37 45

Other fixed annuity contract charges 19 18 18

Total — Allstate Annuities 23 55 63

Life and annuity premiums and contract charges (1) $ 2,157 $ 2,352 $ 2,241

(1) Contract charges related to the cost of insurance totaled $593 million, $725 million and $696 million in 2014, 2013 and 2012,

respectively.

Total premiums and contract charges decreased 8.3% or $195 million in 2014 compared to 2013. Excluding results

of the LBL business for second through fourth quarter 2013 of $254 million, premiums and contract charges increased

$59 million in 2014 compared to 2013, primarily due to growth in Allstate Benefits accident and health insurance

business and increased traditional life insurance premiums due to higher renewals and sales through Allstate agencies,

partially offset by lower premiums on immediate annuities with life contingencies due to discontinuing new sales

January 1, 2014. The growth at Allstate Benefits primarily relates to accident and critical illness products and an increase

in the number of employer groups.

Total premiums and contract charges increased 5.0% in 2013 compared to 2012, primarily due to growth in Allstate

Benefits accident and health insurance business, higher contract charges on interest-sensitive life insurance products

primarily resulting from the aging of our policyholders and growth of insurance in force, and increased traditional life

insurance premiums due to lower reinsurance premiums ceded and higher sales and renewals through Allstate agencies,

partially offset by lower sales of immediate annuities with life contingencies.

Allstate agencies and exclusive financial specialists continue to sell LBL life products until Allstate Financial

transitions these products to Allstate Assurance Company beginning first quarter 2015. LBL life business sold through

the Allstate agency channel and all LBL payout annuity business continues to be reinsured and serviced by Allstate Life

Insurance Company (‘‘ALIC’’). Following the closing of the sale, LBL was rated A- from A.M. Best and BBB+ from

Standard & Poor’s (‘‘S&P’’). ALIC is rated A+ by A.M. Best, A+ by S&P and A1 by Moody’s. Allstate Assurance Company

is rated A by A.M. Best and A1 by Moody’s. As of December 31, 2014, ALIC assumed from LBL $3.82 billion of reserves

for life-contingent contract benefits and contractholder funds. In 2014, life and annuity premiums and contract charges

of $784 million, contract benefits of $487 million, and interest credited to contractholder funds of $166 million were

assumed from LBL. Allstate will continue to service the LBL business that was sold until the servicing transitions to third

party administration companies, which have experienced delays and are expected to be completed in 2015.

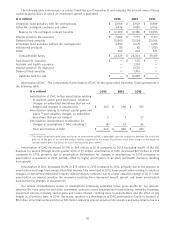

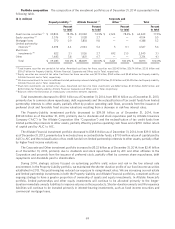

Contractholder funds represent interest-bearing liabilities arising from the sale of products such as interest-sensitive

life insurance, fixed annuities and funding agreements. The balance of contractholder funds is equal to the cumulative

deposits received and interest credited to the contractholder less cumulative contract benefits, surrenders, withdrawals,

60