Allstate 2014 Annual Report Download - page 167

Download and view the complete annual report

Please find page 167 of the 2014 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

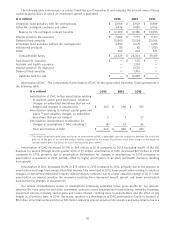

brokerage agency distribution channel, discontinuing sales of proprietary annuity products, and other rightsizing and

profitability actions.

General and administrative expenses decreased 5.5% or $23 million in 2013 compared to 2012, primarily due to

lower employee related expenses and proceeds received from a litigation settlement.

Loss on disposition of $90 million in 2014 and $687 million in 2013 include $101 million and $698 million of losses

relating to the LBL sale, respectively. Gain on disposition of $18 million in 2012 related to the amortization of the

deferred gain from the disposition through reinsurance of substantially all of our variable annuity business in 2006, and

the sale of Surety Life Insurance Company, which was not used for new business, in third quarter 2012.

Reinsurance ceded We enter into reinsurance agreements with unaffiliated reinsurers to limit our risk of mortality

and morbidity losses. In addition, Allstate Financial has used reinsurance to effect the disposition of certain blocks of

business. We retain primary liability as a direct insurer for all risks ceded to reinsurers. As of December 31, 2014 and

2013, 23% and 36%, respectively, of our face amount of life insurance in force was reinsured. Additionally, we ceded

substantially all of the risk associated with our variable annuity business.

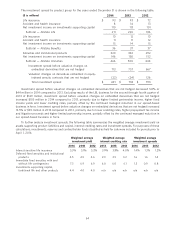

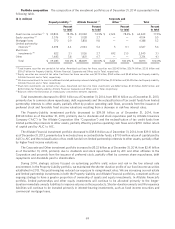

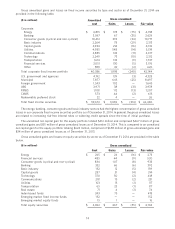

Our reinsurance recoverables, summarized by reinsurer as of December 31, are shown in the following table.

($ in millions) Standard & Poor’s Reinsurance

financial recoverable on paid

strength rating (4) and unpaid benefits

2014 2013

Prudential Insurance Company of America AA- $ 1,461 $ 1,510

RGA Reinsurance Company AA- 262 305

Swiss Re Life and Health America, Inc. (1) AA- 160 186

Paul Revere Life Insurance Company A 116 121

Munich American Reassurance AA- 98 109

Mutual of Omaha Insurance A+ 92 92

Transamerica Life Group AA- 84 88

Security Life of Denver A- 84 48

Scottish Re Group N/A 82 104

Manulife Insurance Company AA- 57 59

Triton Insurance Company N/A 53 54

Lincoln National Life Insurance AA- 37 39

General Re Life Corporation AA+ 26 25

American Health & Life Insurance Co. N/A 22 44

SCOR Global Life A+ 17 21

Other (2) 56 67

Total (3) $ 2,707 $ 2,872

(1) The Company has extensive reinsurance contracts directly with Swiss Re and its affiliates and indirectly through Swiss

Re’s acquisition of other companies with whom we had reinsurance or retrocession contracts.

(2) As of December 31, 2014 and 2013, the other category includes $44 million and $58 million, respectively, of

recoverables due from reinsurers with an investment grade credit rating from Standard & Poor’s (‘‘S&P’’).

(3) Reinsurance recoverables classified as held for sale were $1.66 billion as of December 31, 2013.

(4) N/A reflects no rating available.

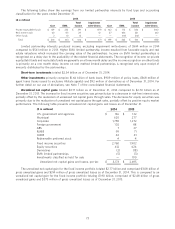

We continuously monitor the creditworthiness of reinsurers in order to determine our risk of recoverability on an

individual and aggregate basis, and a provision for uncollectible reinsurance is recorded if needed. No amounts have

been deemed unrecoverable in the three-years ended December 31, 2014.

We enter into certain intercompany reinsurance transactions for the Allstate Financial operations in order to

maintain underwriting control and manage insurance risk among various legal entities. These reinsurance agreements

have been approved by the appropriate regulatory authorities. All significant intercompany transactions have been

eliminated in consolidation.

67