Allstate 2014 Annual Report Download - page 243

Download and view the complete annual report

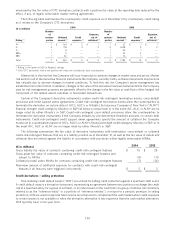

Please find page 243 of the 2014 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.statutory-basis financial statements in conformity with accounting practices prescribed or permitted by the State of

Michigan Department of Insurance and Financial Services (‘‘MI DOI’’). The MI DOI has granted the MCCA a statutory

permitted practice that expires in 2016 to discount its liabilities for loss and loss adjustment expense. As of June 30,

2014, the date of its most recent annual financial report, the permitted practice reduced the MCCA’s accumulated

deficit by $51.24 billion to $411 million.

Allstate sells and administers policies as a participant in the National Flood Insurance Program (‘‘NFIP’’). The

amounts recoverable as of December 31, 2014 and 2013 were $7 million and $32 million, respectively. Ceded premiums

earned include $312 million, $316 million and $311 million in 2014, 2013 and 2012, respectively. Ceded losses incurred

include $38 million, $289 million and $758 million in 2014, 2013 and 2012, respectively. Under the arrangement, the

Federal Government pays all covered claims.

The NJUCJF provides compensation to qualified claimants for bodily injury or death caused by private passenger

automobiles operated by uninsured or ‘‘hit and run’’ drivers. The fund also provides reimbursement to insurers for the

medical benefits portion of personal injury protection coverage paid in excess of $75,000 with no limits for policies

issued or renewed prior to January 1, 1991 and in excess of $75,000 and capped at $250,000 for policies issued or

renewed from January 1, 1991 to December 31, 2004. The amounts recoverable as of December 31, 2014 and 2013 were

$508 million and $378 million, respectively.

Ceded premiums earned under the Florida Hurricane Catastrophe Fund (‘‘FHCF’’) agreement were $11 million,

$16 million and $18 million in 2014, 2013 and 2012, respectively. There were no ceded losses incurred in 2014, 2013 or

2012. The Company has access to reimbursement provided by the FHCF for 90% of qualifying personal property losses

that exceed its current retention of $69 million for the 2 largest hurricanes and $23 million for other hurricanes, up to a

maximum total of $184 million effective from June 1, 2014 to May 31, 2015. There were no amounts recoverable from the

FHCF as of December 31, 2014 or 2013.

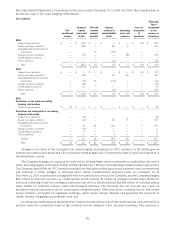

Catastrophe reinsurance

The Company has the following catastrophe reinsurance agreements in effect as of December 31, 2014:

The Nationwide Per Occurrence Excess Catastrophe Reinsurance program (the ‘‘Nationwide program’’) comprising

four agreements: The Per Occurrence Excess Catastrophe Reinsurance agreement, the 2013-1 Property Claim Services

(‘‘PCS’’) Excess Catastrophe Reinsurance agreement, the 2014-1 PCS Excess Catastrophe Reinsurance agreement, and

the Buffer Layer Excess Catastrophe Reinsurance agreement.

• The Per Occurrence Excess Catastrophe Reinsurance agreement comprises seventeen contracts placed in six

layers and incepting as of June 1, 2014. Coverage for each of the first through fifth layers comprises three

contracts with one, two and three year terms expiring May 31, 2015, May 31, 2016 and May 31, 2017. Coverage

for the sixth layer comprises two contracts with two and three year terms expiring May 31, 2016 and May 31,

2017. This agreement reinsures Allstate Protection for personal lines property and automobile excess

catastrophe losses countrywide, in all states except Florida and New Jersey, caused by multiple perils. Each of

the layers is 95% placed and subject to reinstatement. The agreement covers $2.95 billion in per occurrence

losses subject to a $500 million retention.

• The 2013-1 PCS Excess Catastrophe Reinsurance agreement comprises two contracts: a Class B Excess

Catastrophe Reinsurance contract that constitutes a portion of the seventh layer and provides $150 million in

limits excess of a $2.95 billion retention, and a Class A Excess Catastrophe Reinsurance contract which

constitutes a portion of the ninth layer of the Nationwide program and provides $200 million in limits excess of

a $3.5 billion retention. The agreement reinsures Allstate Protection for personal lines property and automobile

excess catastrophe losses caused by hurricanes in 28 states and the District of Columbia, and earthquakes,

including fires following earthquakes, in California, New York and Washington. The contracts’ risk period began

May 4, 2013 and expires on May 3, 2017. The contracts do not include a reinstatement of limits.

• The 2014-1 PCS Excess Catastrophe Reinsurance agreement comprises three contracts: a Class D Excess

Catastrophe Reinsurance contract that constitutes a portion of the seventh layer of the Nationwide program

and provides $305 million in limits excess of a $2.95 billion attachment level, a Class C Excess Catastrophe

Reinsurance contract which constitutes a portion of the ninth layer of the Nationwide program and provides

$115 million in limits excess of a $3.50 billion attachment level, and a Class B Excess Catastrophe Reinsurance

contract which constitutes the tenth layer of the Nationwide program and provides $330 million in limits excess

of a $3.83 billion attachment level. The agreement reinsures Allstate Protection for personal lines property and

automobile excess catastrophe losses caused by hurricanes in 29 states and the District of Columbia, and

143