Allstate 2014 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2014 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Often, several different estimates are prepared for each detailed component, incorporating alternative analyses of

changing claim settlement patterns and other influences on losses, from which we select our best estimate for each

component, occasionally incorporating additional analyses and actuarial judgment, as described above. These micro-

level estimates are not based on a single set of assumptions. Actuarial judgments that may be applied to these

components of certain micro-level estimates generally do not have a material impact on the consolidated level of

reserves. Moreover, this detailed micro-level process does not permit or result in a compilation of a company-wide roll

up to generate a range of needed loss reserves that would be meaningful. Based on our review of these estimates, our

best estimate of required reserves for each state/line/coverage component is recorded for each accident year, and the

required reserves for each component are summed to create the reserve balance carried on our Consolidated

Statements of Financial Position.

Reserves are reestimated quarterly and periodically throughout the year, by combining historical results with

current actual results to calculate new development factors. This process incorporates the historic and latest actual

trends, and other underlying changes in the data elements used to calculate reserve estimates. New development

factors are likely to differ from previous development factors used in prior reserve estimates because actual results

(claims reported or settled, losses paid, or changes to case reserves) occur differently than the implied assumptions

contained in the previous development factor calculations. If claims reported, paid losses, or case reserve changes are

greater or less than the levels estimated by previous development factors, reserve reestimates increase or decrease.

When actual development of these data elements is different than the historical development pattern used in a prior

period reserve estimate, a new reserve is determined. The difference between indicated reserves based on new reserve

estimates and recorded reserves (the previous estimate) is the amount of reserve reestimate and is recognized as an

increase or decrease in property-liability insurance claims and claims expense in the Consolidated Statements of

Operations. Total Property-Liability net reserve reestimates, after-tax, as a percent of net income available to common

shareholders were favorable 2.0%, 3.5%, and 18.7% in 2014, 2013 and 2012, respectively. The 3-year average of net

reserve reestimates as a percentage of total reserves was a favorable 1.7% for Property-Liability, a favorable 2.5% for

Allstate Protection and an unfavorable 6.2% for Discontinued Lines and Coverages, each of these results being

consistent within a reasonable actuarial tolerance for our respective businesses. A more detailed discussion of reserve

reestimates is presented in the Property-Liability Claims and Claims Expense Reserves section of this document.

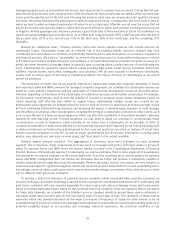

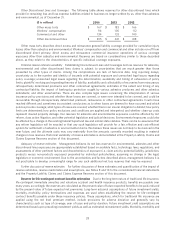

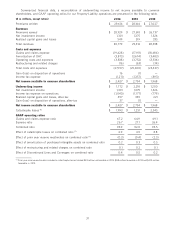

The following table shows net claims and claims expense reserves by segment and line of business as of

December 31:

($ in millions) 2014 2013 2012

Allstate Protection

Auto $ 11,698 $ 11,616 $ 11,383

Homeowners 1,849 1,821 2,008

Other lines 2,070 2,110 2,250

Total Allstate Protection 15,617 15,547 15,641

Discontinued Lines and Coverages

Asbestos 1,014 1,017 1,026

Environmental 203 208 193

Other discontinued lines 395 421 418

Total Discontinued Lines and Coverages 1,612 1,646 1,637

Total Property-Liability $ 17,229 $ 17,193 $ 17,278

Allstate Protection reserve estimates

Factors affecting reserve estimates Reserve estimates are developed based on the processes and historical

development trends described above. These estimates are considered in conjunction with known facts and

interpretations of circumstances and factors including our experience with similar cases, actual claims paid, historical

trends involving claim payment patterns and pending levels of unpaid claims, loss management programs, product mix

and contractual terms, changes in law and regulation, judicial decisions, and economic conditions. When we experience

changes of the type previously mentioned, we may need to apply actuarial judgment in the determination and selection

of development factors considered more reflective of the new trends, such as combining shorter or longer periods of

historical results with current actual results to produce development factors based on two-year, three-year, or longer

development periods to reestimate our reserves. For example, if a legal change is expected to have a significant impact

on the development of claim severity for a coverage which is part of a particular line of insurance in a specific state,

23