Allstate 2014 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2014 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280

|

|

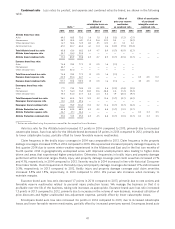

freeze losses not meeting our criteria to be declared a catastrophe), are accrued on an occurrence basis within the policy

period. Therefore, in any reporting period, loss experience from catastrophic events and weather-related losses may

contribute to negative or positive underwriting performance relative to the expectations we incorporated into the

products’ pricing. We pursue rate increases where indicated, taking into consideration potential customer disruption,

the impact on our ability to market our auto lines, regulatory limitations, our competitive position and profitability, using

a methodology that appropriately addresses the changing costs of losses from catastrophes such as severe weather and

the net cost of reinsurance.

Allstate Protection outlook

• Allstate Protection will continue to focus on its strategy of offering differentiated products and services to our

customers while maintaining pricing discipline.

• We expect that volatility in the level of catastrophes we experience will contribute to variation in our

underwriting results; however, this volatility will be mitigated due to our catastrophe management actions,

including the purchase of reinsurance.

• We will continue our evolution to a trusted advisor model, enabling agencies to more fully deliver on the

Allstate brand customer value proposition.

• We will continue to modernize our operating model to efficiently deliver our customer value propositions.

• We will invest in building long-term growth platforms.

Premiums written is the amount of premiums charged for policies issued during a fiscal period. Premiums are

considered earned and are included in the financial results on a pro-rata basis over the policy period. The portion of

premiums written applicable to the unexpired term of the policies is recorded as unearned premiums on our

Consolidated Statements of Financial Position.

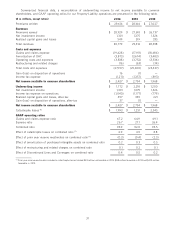

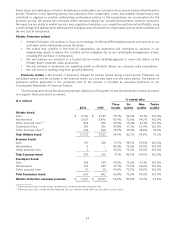

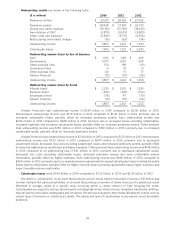

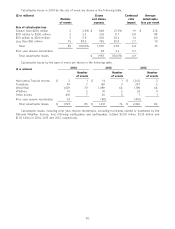

The following table shows the unearned premium balance as of December 31 and the timeframe in which we expect

to recognize these premiums as earned.

% earned after

($ in millions)

Three Six Nine Twelve

2014 2013 months months months months

Allstate brand:

Auto $ 4,766 $ 4,533 70.7% 96.2% 99.1% 100.0%

Homeowners 3,607 3,496 43.4% 75.5% 94.2% 100.0%

Other personal lines (1) 833 819 43.5% 75.4% 94.1% 100.0%

Commercial lines 254 236 43.8% 75.1% 93.9% 100.0%

Other business lines (2) 642 468 18.9% 33.3% 45.4% 55.3%

Total Allstate brand 10,102 9,552 54.9% 82.7% 93.4% 97.2%

Esurance brand:

Auto 371 328 73.7% 98.5% 99.6% 100.0%

Homeowners 6 — 43.4% 75.6% 94.2% 100.0%

Other personal lines 2 1 43.5% 75.4% 94.2% 100.0%

Total Esurance brand 379 329 73.1% 98.0% 99.5% 100.0%

Encompass brand:

Auto 345 335 43.8% 75.6% 94.1% 100.0%

Homeowners 274 253 43.7% 75.7% 94.2% 100.0%

Other personal lines 57 54 43.9% 75.7% 94.2% 100.0%

Total Encompass brand 676 642 43.8% 75.6% 94.2% 100.0%

Allstate Protection unearned premiums $ 11,157 $ 10,523 54.8% 82.8% 93.7% 97.4%

(1) Other personal lines include renter, condominium, landlord and other personal lines.

(2) Other business lines include Allstate Roadside Services, Allstate Dealer Services and other business lines.

34